The Furniture and Home Goods sector is characterized by high average order values (AOV) and complex delivery logistics. This means independent sellers must choose platforms that offer either massive traffic or specialized delivery solutions to handle bulky items effectively.

Here, we’ve rounded up the big hitters – in the US and globally – to help you decide which platform is best for your furniture-selling business in 2025.

The US Landscape: Generalists, Home-Specific Giants, and Curated Retailers

The US market relies on generalists for initial visibility, but dedicated home platforms provide necessary services like specialized freight and white-glove delivery.

1. Amazon (Furniture Category)

- Buyer Scale: 310M+ active users worldwide (massive US share); leads in units sold.

- Key Features: Huge reach; offers FBA for smaller items; third-party carriers manage LTL (Less-Than-Truckload) freight for bulky furniture.

- Seller Pros: Unmatched volume and visibility; strong consumer trust; Prime benefits drive high conversion.

- Seller Cons: High competition; fees are high (typically 15% up to $200, then 10%); complexity of coordinating freight shipping.

2. Walmart Marketplace

- Buyer Scale: ~480–500M monthly site visits; with strong growth in the Home category.

- Key Features: 3P marketplace for both essential and decorative furniture; leveraging their physical network for fulfillment of non-bulky items.

- Seller Pros: Less seller competition than Amazon; generally lower referral fees; strong focus on competitive value pricing.

- Seller Cons: Products must be approved; often requires using seller-managed LTL shipping for large items; lower luxury appeal.

3. Wayfair (Marketplace/Supplier Model)

- Buyer Scale: ~21M active customers; high repeat customer rate (~80% of orders are from repeat buyers).

- Key Features: Home-only platform; operates primarily on a drop-ship supplier model (DFM). Sellers control inventory, but Wayfair controls pricing and logistics.

- Seller Pros: Specialized logistics for furniture (delivery, returns, white-glove); high brand recognition in the Home sector.

- Seller Cons: Very high entry barrier; seller loses control over customer pricing and data; operation is more like a wholesale supplier contract.

4. Etsy

- Buyer Scale: ~95M active buyers (as of 2025).

- Key Features: Specialized in handmade, vintage, reclaimed, and custom furniture (e.g., custom tables, unique décor).

- Seller Pros: High-intent audience looking for unique/artisan pieces; high AOV for custom work.

- Seller Cons: Limited to unique, vintage, or handmade items; massive shipping costs often deter impulse buys.

5. TikTok Shop (US)

- Buyer Scale: ~47M social media shoppers (2025 est.).

- Key Features: Live and social commerce; focuses on décor, small furniture (e.g., side tables, storage solutions), and viral organization items.

- Seller Pros: Excellent for trend-driven accessories and small, shippable furniture; low introductory referral fee (~6%).

- Seller Cons: Unsuitable for large or high-value furniture; impulse-driven sales lead to high return rates.

New: Curated Retailer Marketplaces (US)

These platforms offer a highly vetted selling environment with less direct competition than Amazon, leveraging their brand loyalty and omnichannel strength.

6. Bed Bath & Beyond (Beyond Inc.)

- Buyer Scale: Millions of monthly unique visitors; loyal customer base focused entirely on Home Goods.

- Key Features: Pure-play eCommerce platform (all physical stores closed); actively expanding furniture and home goods assortment through a 3P Partner Program.

- Seller Pros: 100% focus on the home category; high visibility among customers with high home-goods intent; streamlined partner onboarding.

- Seller Cons: Smaller absolute sales volume than Amazon or Walmart; currently rebuilding brand trust under the new ownership (Beyond Inc.).

7. Macy’s Marketplace

- Buyer Scale: 29M+ loyalty members; high volume of site traffic across fashion and home.

- Key Features: Highly curated, invite-only 3P marketplace; strong presence in high-end Home and Décor adjacent to their core apparel business.

- Seller Pros: Access to an affluent, brand-loyal customer base; less competition due to strict curation; sellers can opt into major Macy’s promotions.

- Seller Cons: Very strict vetting and operational requirements (e.g., US-based fulfillment, GS1 UPCs); furniture items over 150 lbs. require special approval.

8. Best Buy Marketplace

- Buyer Scale: 200M+ customers annually; over 10 billion site views per year.

- Key Features: Recently launched 3P marketplace; focusing on Office Furniture, Gaming Chairs/Desks, and Home Tech (TV stands, smart furniture).

- Seller Pros: Access to Best Buy’s massive, high-tech customer base; customers can return 3P items to physical stores (a huge advantage for bulky goods).

- Seller Cons: High vetting and selective process to protect brand quality; product must be adjacent to electronics or office tech.

US Fee Notes

- Amazon Furniture: Referral fees are typically 15% on the first $200 of the sale price, and 10% on the portion above $200.

- Wayfair: Operates on a margin model.

- Etsy: A 6.5% transaction fee plus a $0.20 listing fee.

- Macy’s Marketplace: Commission is typically 15% of the sale price.

- Best Buy Marketplace: Referral fees typically start around 8% for some categories but can vary; requires adherence to strict performance standards.

The European Landscape: DIY Specialists and Home Curators

Europe features dedicated home and DIY marketplaces that specialize in the bulky goods logistics required for furniture.

1. ManoMano

- Region: Pan-EU (FR, DE, UK, ES, IT).

- Buyer Scale: 50M monthly visitors; Europe’s leading DIY, Home Improvement, and Garden specialist.

- Key Features: Dedicated to the Home & Garden categories; strong focus on tools, building, and larger home installations (including furniture).

- Seller Pros: Highly targeted audience; offers specialized ManoMano Fulfillment for bulky items.

- Seller Cons: High commission rates (typically 15-25%) plus a monthly subscription fee; strong competition within building materials.

2. OTTO (Marketplace)

- Region: Germany (DE) + expanding across Europe.

- Buyer Scale: Over 9M active customers; Germany’s second-largest general retailer.

- Key Features: Strong presence in the Home, Furniture, and Lifestyle categories; operates a pure 3P marketplace model.

- Seller Pros: High customer trust in the crucial German market; lower returns compared to fashion; OTTO handles payment processing.

- Seller Cons: Requires a high, one-time setup fee; strong focus on German localization.

3. Home24

- Region: Germany (DE) + broader EU presence (e.g., France).

- Buyer Scale: Over 2M active customers; ~4.2M monthly visits.

- Key Features: Highly curated marketplace specializing in Furniture and Home & Living; known for modern design focus.

- Seller Pros: High brand awareness in the DACH region for furniture; direct competitor to Wayfair/IKEA with a 3P model.

- Seller Cons: Smaller scale compared to Amazon or OTTO; requires compliance with local EU/German quality standards.

4. 1stDibs

- Region: Global, focus on high-spending customers.

- Buyer Scale: ~64K active buyers; 7.0M registered users (very high AOV).

- Key Features: Niche platform for Luxury, Vintage, Antique Furniture, and High-End Home Décor.

- Seller Pros: Access to an affluent, global interior designer and collector audience; very high AOV and perceived prestige.

- Seller Cons: Very high commission rates (25%+); extremely rigorous vetting and curation process.

5. Cdiscount

- Region: France (FR) + Benelux, Germany.

- Key Features: France’s second-largest marketplace; generalist with a strong offering in Home and Furniture; offers 3P fulfillment.

- Seller Pros: High visibility in the French market; offers Cdiscount Fulfillment (FC) for bulky goods.

- Seller Cons: Reputation leans towards value/discount, which may challenge premium furniture brands.

European Fee Notes

- ManoMano: High commission (15-25%) plus a monthly subscription fee.

- OTTO: Commission varies but is competitive; requires a significant initial fee.

- 1stDibs: Very high commission (25%+) reflecting the luxury/niche service.

Choosing Your Platform: Strategy by Objective

| Objective | Recommended Marketplaces (US & EU) | Key Strategy Note |

| Maximum Volume/Scale | Amazon (US/EU), Walmart (US) | Focus on small-to-mid-size furniture that can be drop-shipped or freight-shipped easily. |

| Bulky/Complex Logistics | Wayfair (Supplier), ManoMano (EU) | Partner with platforms that offer built-in, specialized fulfillment and returns for heavy goods. |

| Curated/High-Trust Audience | Macy’s, Best Buy (US) | Utilize the low-competition environment to target highly loyal, high-intent brand customers. |

| High-End/Vintage Furniture | 1stDibs (Global), Etsy (Custom/Vintage) | Prioritize exceptional photography, detailed descriptions, and high-touch customer service. |

| German/Central European Focus | OTTO, Home24 (DE) | Leverage the high brand trust and dedicated audience of regional furniture specialists. |

| Home Goods Volume | Bed Bath & Beyond (Beyond Inc.) (US) | Essential platform for increasing digital visibility and assortment in the pure-play home space. |

Key Considerations for Furniture Sellers

- Logistics: The biggest hurdle is Last-Mile Delivery and returns of large items. Furniture success hinges on having a reliable LTL (Less-Than-Truckload) carrier network and clear policies for white-glove delivery (assembly, placement, and debris removal).

- Visualization: Since customers can’t touch the product, platforms that support 3D visualization, Augmented Reality (AR), and numerous high-resolution photos are essential to reduce returns.

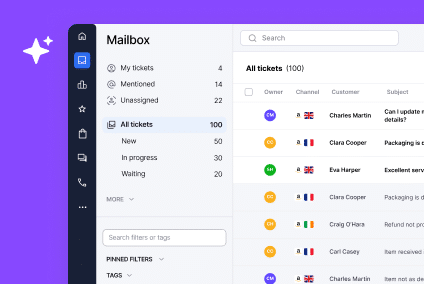

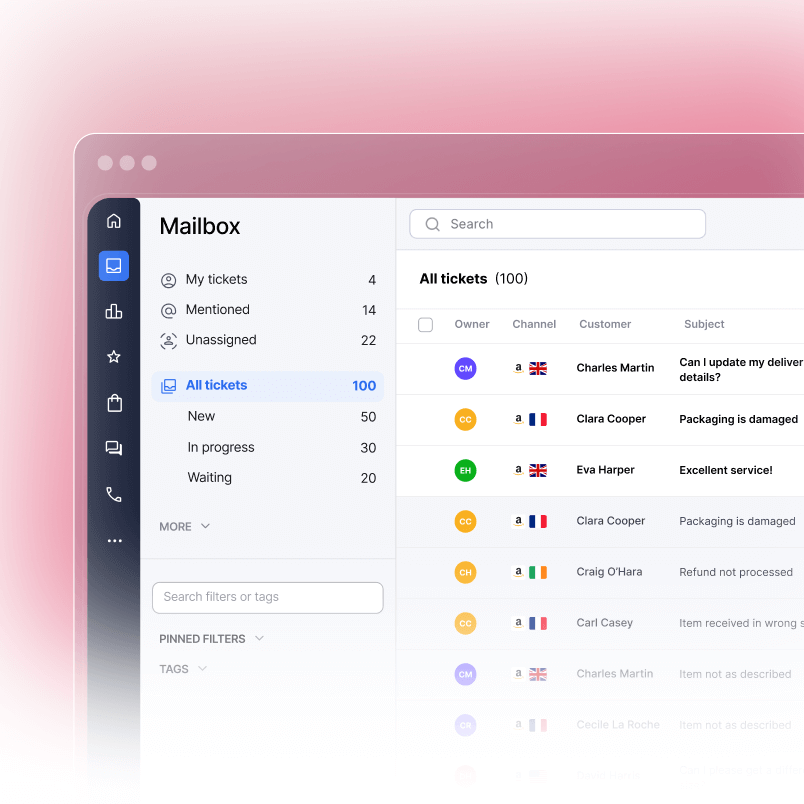

- Customer Service: Furniture has a high AOV, making customer satisfaction critical. Inquiries often involve complex assembly instructions, delayed freight, or damage in transit. A multi-channel eCommerce helpdesk solution is necessary to centralize and quickly resolve these high-value, high-stress customer tickets.

Need help managing your online food orders or customer support across multiple marketplaces? Book a demo with eDesk today and discover how we can help you centralize messages, streamline operations, and grow your business with less effort.