The UK’s thriving eCommerce sector faces unprecedented fraud challenges. With global eCommerce fraud losses reaching £48 billion annually and 50% of UK businesses experiencing cybersecurity breaches in 2024, protecting your online store has never been more critical. Alarmingly, phishing attacks account for 84% of all cybersecurity incidents affecting UK businesses, making customer support teams your first line of defence.

The Current State of eCommerce Fraud in the UK

The scale of online fraud targeting UK businesses is staggering. £1.17 billion was stolen through fraud in 2024, affecting nearly 3 million cases. Europe accounts for 26% of global eCommerce fraud by value, with the UK particularly vulnerable due to its advanced digital payment infrastructure.

Key statistics reveal the severity:

- Card-not-present fraud accounts for £395.7 million in unauthorised transactions in the UK

- 45% of UK shoppers admit to return fraud or policy abuse, representing £22.8 billion in fraudulent returns

- 93% of UK companies were targeted by fraud in the past year

- Chargeback management UK businesses face costs amounting to an estimated £117.47 billion globally

Common Types of eCommerce Fraud Affecting UK Businesses

Phishing Scams and Social Engineering

Phishing remains the top threat, with modern attacks employing AI-powered tools to create convincing communications that mimic legitimate businesses. These sophisticated schemes target both merchants and customers through deceptive emails and fake websites designed to steal credentials and payment information.

Payment Fraud and Account Takeover

Account takeover fraud increased by 7% in 2023, now representing 29% of all fraud cases. Criminals gain unauthorised access to customer accounts using compromised credentials from data breaches or phishing campaigns, whilst card-not-present fraud exploits online payment vulnerabilities.

Friendly Fraud and Chargeback Abuse

Chargeback fraud affects 34% of global eCommerce, with legitimate customers disputing valid transactions. This creates particular challenges as it involves seemingly trustworthy customers making false claims about their purchases.

Triangulation Fraud

This sophisticated scheme involves fraudsters creating fake marketplaces, collecting customer details, and then using stolen cards to fulfil orders from legitimate retailers. Triangulation fraud costs merchants £130 billion globally.

How Customer Support Teams Prevent and Identify Fraud

Recognising Suspicious Activities

Effective customer verification requires understanding suspicious behaviour patterns:

Unusual Purchase Patterns: Multiple high-value purchases in short timeframes with different billing and shipping addresses often indicate fraud.

Communication Inconsistencies: Fraudsters struggle to answer basic questions about orders or personal information, unlike legitimate customers who provide consistent details.

Payment Irregularities: Multiple failed attempts, frequent payment method changes, or artificial urgency signals potential fraud.

Implementing Robust Customer Verification

Building customer confidence requires verification processes that balance online payment security with user experience:

- Multi-Factor Authentication: Encourage two-factor authentication to prevent account takeovers

- Order Verification Questions: Train staff to ask specific questions that only legitimate account holders would know

- Address and Payment Verification: Implement protocols ensuring billing addresses match payment registrations

- Documentation Requirements: Require additional ID for suspicious high-value transactions

Training on Cybersecurity UK Best Practices

Support teams need comprehensive training covering:

- Phishing Recognition: Identifying email spoofing, fake websites, and social engineering

- Secure Communication: Never requesting sensitive information via unsecured channels

- Escalation Procedures: Clear protocols for suspicious activity reporting

- Regular Updates: Ongoing education about emerging threats

Managing Payment Disputes

Managing PayPal Chargebacks effectively requires understanding dispute processes and maintaining detailed records. Support teams should document interactions thoroughly and respond promptly to prevent escalation.

UK Payment Systems and Security Measures

The UK’s payment infrastructure includes robust security measures. Strong Customer Authentication implementation led to 75% of UK retailers reporting decreased online payment fraud. However, Authorised Push Payment fraud accounts for 40% of UK fraud losses, requiring continued vigilance.

Building Customer Confidence Through Support Excellence

Proactive Security Communication

Rather than waiting for security concerns, proactive teams regularly communicate about protective measures, share fraud prevention tips, and update customers about emerging threats, demonstrating a commitment to their protection.

Transparent Policies and Education

Clear communication about security practices builds trust. eDesk Privacy Policy for Data Security exemplifies transparent security communication. Guiding Customers on Security with Knowledge Base resources empowers customers with comprehensive guides and regular updates.

Responsive Fraud Reporting

Rapid response to customer fraud reports demonstrates security commitment. Support teams need clear investigation protocols and communication procedures for affected customers.

Technology Solutions for Enhanced Prevention

Modern fraud prevention combines human expertise with advanced technology:

- AI-Powered Detection: 35% of merchants use machine learning for fraud management, increasing to 41% in 2023

- Real-Time Monitoring: Advanced systems identify suspicious activities as they occur

- Behaviour Analytics: Understanding normal patterns helps identify anomalies indicating fraud

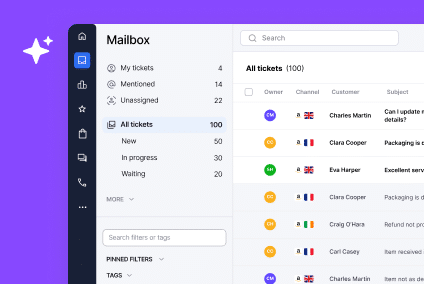

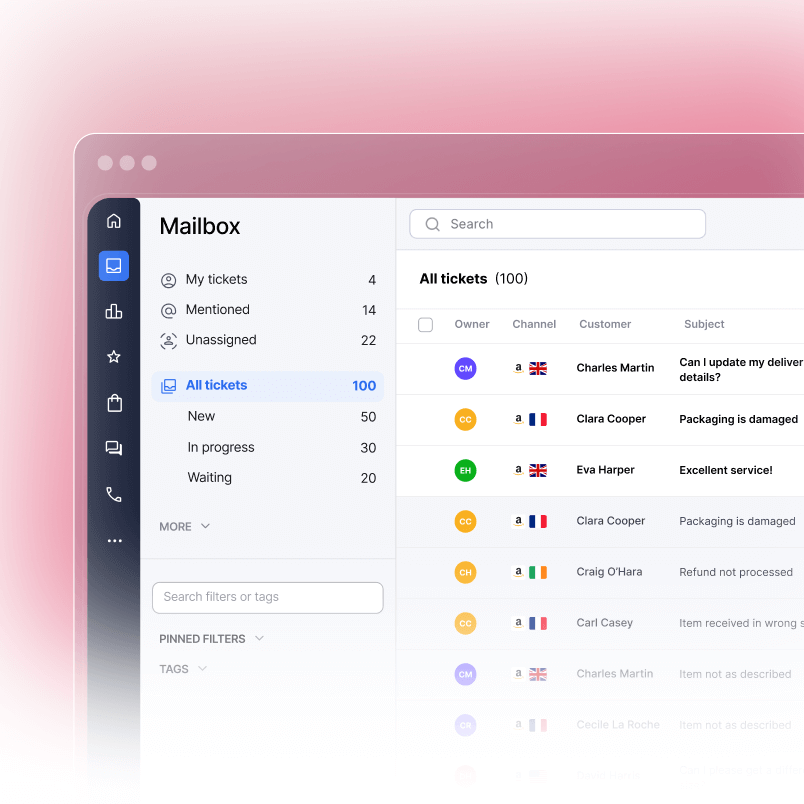

- Integrated Platforms: Centralised communication maintains comprehensive interaction records

Measuring Success and Future-Proofing

Effective prevention requires ongoing measurement through fraud detection rates, false positives, customer satisfaction, response times, and prevention costs. The evolving landscape demands continuous adaptation to emerging threats like AI-powered fraud tools and deepfake technology.

Success requires treating security as an ongoing partnership between business and customers, built on trust, transparency, and proactive protection. Support teams must stay current with new technologies while maintaining focus on exceptional customer experiences that build lasting confidence in secure transactions.

Protecting your UK eCommerce store requires comprehensive fraud prevention, combining technology, training, and exceptional customer support. By empowering support teams to identify suspicious activities whilst guiding customers through security protocols, you create a robust defence against sophisticated fraud schemes. Try eDesk for free today and transform your fraud prevention strategy.