Bottom Line Up Front: UK GDPR compliance isn’t just about avoiding fines—it’s your most powerful tool for building customer trust. With over 2,245 GDPR fines totalling €5.65 billion across Europe and British consumers prioritising data security as their top concern, transparent data handling has become essential for eCommerce success.

In today’s digital landscape, UK consumers are more cautious than ever about sharing personal information online. Recent research reveals that 19% of consumers have been informed that their personal data has been compromised in the past year, whilst 68% reduced online purchases from affected brands following a data breach. For UK eCommerce businesses, this presents both a challenge and an opportunity.

The Current State of UK eCommerce Trust

The trust landscape in UK eCommerce is shifting dramatically. More than half (58% of consumers) believe brands that get hit with a data breach are not trustworthy, and 70% would stop shopping with a brand that suffered a security incident. Recent high-profile breaches affecting British retailers like Marks & Spencer, Harrods, and Co-op have heightened consumer awareness, with the majority of UK shoppers saying reports of cyber breaches involving British retailers are affecting their trust in online payments.

However, this crisis creates opportunity. 64% of consumers indicated that their confidence in a brand would significantly increase if they adopted emerging or advanced technologies that improve security and data protection. This means UK GDPR compliance should be viewed as customer experience enhancement, not just regulatory obligation.

Understanding UK GDPR for eCommerce

The UK General Data Protection Regulation (GDPR) remains the cornerstone of data protection UK legislation. The ICO guidelines emphasise transparency, data minimisation, security, and accountability as core principles for eCommerce businesses.

ICO’s Enhanced Enforcement

The ICO has warned 134 of 200 UK websites for failing to meet cookie compliance standards as part of its strategy to bring the UK’s top 1,000 websites into compliance. The regulator has published new guidance on “consent or pay” models, making it clear that websites cannot require users to accept non-essential cookies as a condition of access.

The upcoming Data (Use and Access) Bill will increase maximum fines for privacy breaches from £500,000 to £17.5 million or 4% of annual worldwide turnover, aligning with UK GDPR penalty levels.

Building Customer Trust Through Transparent Data Practices

Clear Privacy Communication

Your privacy policy should use plain English to explain data collection, usage, and retention. eDesk’s Privacy Policy can be used as a good example of transparent communication. Best practices include specific usage examples, clear customer rights explanations, and multiple contact methods for data protection queries.

Transparent Cookie Management

Implement cookie banners that provide genuine choice with clear categorisation of cookie types (essential, analytics, marketing), detailed purpose descriptions, and easy consent withdrawal mechanisms. Regular reviews and updates of your Cookie Notice ensure ongoing compliance.

Proactive Security Communication

Rather than waiting for customer queries, proactively display security badges, provide regular security updates, and clearly explain payment protection measures. This builds confidence before trust issues arise.

Secure Payment Processing for UK Customers

UK consumers favour payment methods offering strong fraud protection. Popular secure online shopping UK options include card payments with 3D Secure authentication, digital wallets like Apple Pay and Google Pay offering tokenised payments, and Buy Now, Pay Later services requiring careful data sharing consideration.

Implement end-to-end encryption, use reputable payment service providers maintaining PCI compliance, and balance fraud detection with user experience. UK consumers expect sophisticated protection without unnecessary transaction complications.

ICO Guidelines and Compliance Requirements

Essential Compliance Steps

Most eCommerce businesses must pay the annual ICO data protection fee, conduct Data Protection Impact Assessments for high-risk processing, and maintain 72-hour breach reporting capabilities. Ensure your Terms and Conditions clearly outline customer rights and data processing activities.

Data Governance Framework

Establish clear data protection responsibility, conduct regular data audits mapping all personal data flows, and implement privacy by design principles including default privacy settings requiring opt-in rather than opt-out preferences.

Data Breach Response and Crisis Management

Government research shows 22% of businesses and 14% of charities experienced cyber crime in the last 12 months, rising to 45% of medium businesses and 58% of large businesses. Develop comprehensive incident response plans with clear escalation procedures, template communications, and technical response protocols.

Research demonstrates that prompt transparency, such as same-day customer alerts, can mitigate 32% of trust erosion compared to delayed disclosures. Crisis communication should include clear acknowledgment of incidents, specific affected data information, concrete remedial steps, and practical customer advice.

Take a look at Understanding Customer Data with Customer View to help you better manage customer data relationships and prepare for potential incidents.

The Business Case for Strong Data Protection

Competitive Advantage Through Trust

37% of consumers only shared personal data with organisations because it was the only way to access products or services, rather than because they trusted the organisation. Businesses building genuine trust achieve higher conversion rates, increased customer lifetime value, better word-of-mouth marketing, and reduced acquisition costs.

Cost-Effective Risk Management

The largest GDPR fine issued in the UK was over £22 million to British Airways, but reputational damage often exceeds financial penalties. Proactive compliance reduces operational costs through streamlined data management, fewer privacy-related customer queries, lower insurance premiums, and more efficient marketing through better data quality.

Future Trends in UK Data Protection

The ICO is developing guidance on AI and automated decision-making, emphasising transparency and human oversight requirements. Consider how emerging technologies might enhance privacy compliance through AI-powered fraud detection, automated data retention management, and enhanced encryption techniques.

Post Brexit, UK businesses must navigate new international data transfer requirements, to ensure data processing agreements and privacy policies clearly address cross-border data protection safeguards.

Building trust through data security and privacy compliance creates sustainable competitive advantages in UK eCommerce. Businesses embracing transparency will avoid regulatory penalties whilst capturing market share from competitors treating privacy as an afterthought.

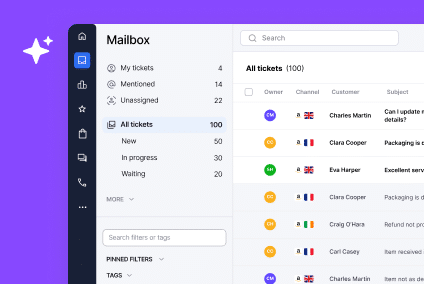

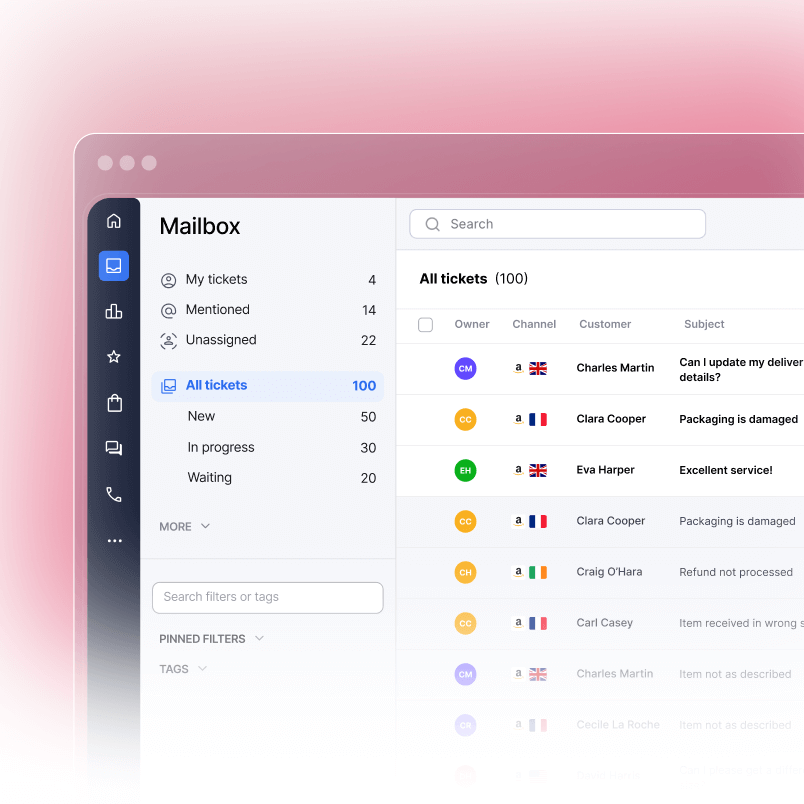

Transform your data protection into a competitive advantage with eDesk’s privacy-focused customer service platform which is designed to help you build customer trust whilst maintaining the highest data protection standards.