Consumers purchased over $8 trillion worth of goods via online marketplaces in 2024, according to current eCommerce statistics. That represents nearly 52% of all eCommerce transactions globally, with European marketplaces capturing a significant portion of this revenue.

So, it makes sense, as an online seller, to make the most of this opportunity by expanding into new European markets. Because although Amazon and eBay dominate worldwide, there are numerous fantastic European online marketplaces that are well worth considering for expanding your brand’s reach.

To help get you started with your European expansion, we’ve compiled a list of the top 12 online marketplaces in Europe for 2025:

Alternative European Marketplaces and Retailers That Are Worth Your Attention

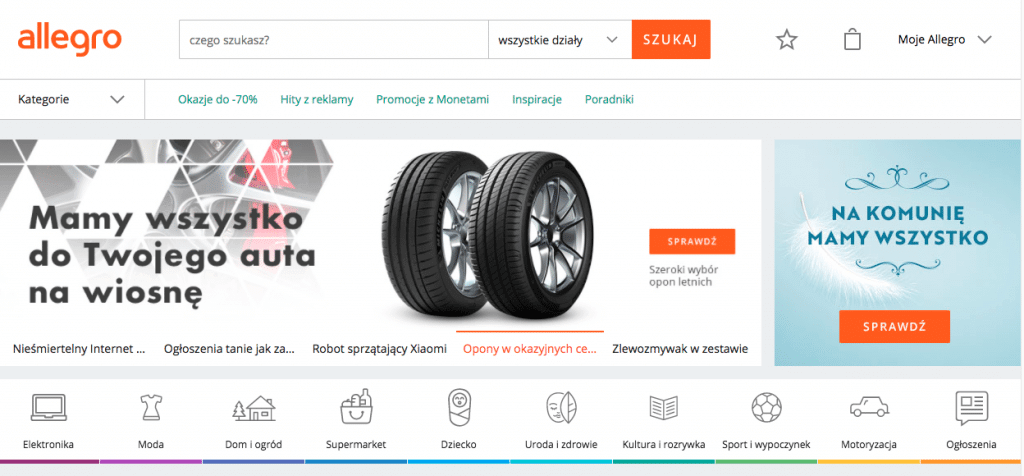

1. Allegro

Who: Allegro is the biggest online marketplace in Poland and the fifth most visited marketplace in Europe.

What: Home goods, kitchenware, clothing, baby items, sports equipment.

When: 1999

Where: Eastern Europe

How much: Commissions and fees are determined using their toll calculator.

Customer profile: Allegro has seen impressive growth, with about 199 million monthly visits and an active customer base of nearly 20 million as of 2025.

Key requirements: Product listings and customer service must be in Polish.

Recent updates: Allegro has expanded to multiple Central European countries, launching platforms in Czechia, Slovakia, and Hungary, allowing merchants to list once and sell across the region. In March 2025, Allegro announced expectations of 8-12% earnings growth in its home market for the year, with a proposed share buyback of approximately 1.4 billion zloty.

2. Cdiscount

Who: Cdiscount is the second most visited eCommerce store in France, after Amazon, selling new and used products. One in three French online shoppers is reportedly a Cdiscount customer.

What: More than 12,000 partner merchants offer products in over 40 categories, including home goods, toys, furniture, baby items, sporting and electronics.

When: 1998

Where: Over 150 countries around the world

How much: A monthly subscription costs €39.99 and commission starts at 5%, depending on the product sold.

Customer profile: Cdiscount has positioned itself as a discount retailer, offering big-name brands for less, such as Samsung, Apple, Michael Kors, Gucci and Lacoste to over 10 million active customers, with approximately 25 million monthly visits in 2025.

Key requirements: Customer service must be offered in French and sellers must be on their country’s Register of Companies and regularly registered with the relevant tax and social security authorities.

Recent updates: Cdiscount has become a pivotal player in the French eCommerce landscape, with 8.8% market share in 2025. The company’s marketplace now accounts for approximately 60% of the site’s Gross Merchandise Volume (GMV), showing the significant shift toward the marketplace model.

3. Fnac

Who: French retailer Fnac operates the country’s third most visited eCommerce site, after Amazon and Cdiscount.

What: More than 10 million electronics and entertainment products from brands such as Samsung, HP, Canon, Huawei and more.

When: Fnac launched its marketplace in 2008.

Where: France, Belgium, Spain, and Portugal

How much: Monthly subscription of €39.90, plus variable commission based on products sold (including shipping and VAT) ranging from 8% to 14%. There are no listing fees.

Customer profile: Fnac has more than 12.4 million unique visitors per month and the average basket size of its client base is high.

Key requirements: Listings and customer support are required to be in French.

Recent updates: Since acquiring Darty in 2018, Fnac has strengthened its position as a trusted source for cultural and electronic products in the French market, making it a valuable European online shopping destination.

4. Otto

Who: Otto is the second largest eCommerce company in Germany, behind Amazon, with a revenue of €7.0 billion in GMV for 2024/2025.

What: The site carries some 1.8 million items from approximately 6,800 brands in categories such as clothing, furniture, kitchenware, toys, household items and electronics.

When: 2016

Where: Operates in more than 20 countries, including Austria, Belgium, Netherlands and Russia.

How much: There is a one-off registration fee of €10,000 and commission ranges from 15% to 50%. That being said, there are no membership or listing fees.

Customer profile: Otto has seen growth to 12.2 million active customers in 2025, mostly aged between 25 and 55, and 9 million registered users. Products range from affordable to premium. Top brands include Only, Nike, Bosch and Philips.

Key requirements: In order to become an Otto seller, you must have a minimum of 100 products, previous marketplace or eCommerce experience and your content must be translated into German.

Recent updates: Otto’s marketplace sales have increased significantly, growing by 24% in the 2024/2025 fiscal year. The company has focused on curating quality partnerships with approximately 6,200 sellers, emphasizing that “quality is non-negotiable” for both Otto and its partners

5. Rakuten PriceMinister

Who: Rakuten PriceMinister, owned by Japanese giant Rakuten Group, is the fifth most visited eCommerce site in France.

What: Everything from new and used books, electronics and home and garden items to shoes, handbags, health and beauty.

When: PriceMinister started in 2000, was acquired by Rakuten in 2010 and rebranded in March 2018.

Where: Rakuten PriceMinister has customers in 20 countries, including France, Belgium, Switzerland and Canada.

How much: Professional seller accounts start at €39 a month, while commission ranges from 4% to 22%, depending on the product category.

Customer profile: The marketplace has 22 million members and 9 million monthly active users. In the women’s apparel category, for instance, the offering spans high-street names such as H&M, Vero Moda and Only to sportswear from Adidas and Nike.

Recent updates: Rakuten has continued to evolve its business model, offering innovative customer rewards through its Rakuten Points program, which has helped maintain customer loyalty in a competitive French market.

6. Kaufland.de

Who: Kaufland.de and Real.de merged in 2021

What: More than 25 million products in over 5,000 categories, including home and garden, electronics, fashion, accessories, camping and baby items, among others.

When: Relaunched in 2021.

Where: Kaufland.de ships to 8 countries.

How much: The basic monthly fee is €39.95, plus VAT, and an additional €9.95 is required to connect to your online store. Third-party sellers enjoy free unlimited listings. Commission (charged on the total price, including shipping) ranges from 6.5% for computers, electronics and household appliances to 12.5% for media items. There are no fees to cancel your account.

Customer profile: Kaufland.de boasts 32 million monthly visitors, and 6.5 million customers.

Recent updates: Since the merger in 2021, Kaufland.de has established itself as one of the top European shopping sites, leveraging its expanded reach and combined customer base.

7. Bol.com

Who: Bol.com is consistently voted the most popular retailer among Dutch consumers for its assortment, fast delivery and convenience.

What: Nearly 40 million items in more than 20 categories including electronics, toys, books, baby items, health and lifestyle products, jewelry and accessories, sports and leisure.

When: Founded in 1999, Bol.com launched its marketplace in 2011.

Where: Belgium and the Netherlands

How much: There are no monthly fees, start-up costs or listing fees and sellers only pay a commission for what is sold. Bol.com’s cut ranges from 5 to 17%, depending on the item.

Customer profile: The marketplace reached €5.8 billion in revenue in 2023 and has almost 13 million active customers in the Netherlands and Belgium. Recent reports show that 67% of Dutch consumers search on bol.com, making it the most popular marketplace in the Netherlands.

Key requirements: You need a valid EAN/GTIN code to sell on bol.com.

Recent updates: Bol.com has experienced strong growth, with sales increasing 8.7% to reach €3.1 billion in 2024. The platform has also reported significant profit growth of 22% in 2025, partly due to double-digit revenue growth in advertising.

8. Spartoo

Who: French marketplace Spartoo is a household name in its home country and across most of Europe.

What: Shoes and clothing.

When: 2006

Where: Operates in 30 European countries, including Belgium, Denmark, Finland, France and the UK, and services customers in 12 different languages.

How much: Monthly membership fee is £35 and commission ranges from 15 to 20%. There are no listing or one-off registration fees.

Customer profile: With 450 million users, Spartoo’s core demographic is women ages 30 to 40.

Key requirements: Spartoo will only work with sellers who can offer a minimum of 250 SKUs.

Recent updates: In their most recent full-year results, Spartoo announced revenue of €149.1 million, continuing to solidify its position as a specialized fashion Amazon alternative in Europe.

9. Zalando

Who: Zalando is a German eCommerce company based in Berlin, with satellite innovation hubs in Helsinki, Dublin, and Lisbon.

What: Over 7,000 fashion and footwear brands, from high street to high end, for men, women, and children.

When: Launched in 2008

Where: Operates in 25 European countries.

How much: Commission is 5-25% per sale.

Customer profile: As of 2025, Zalando continues to be the top European marketplace for Fashion, attracting more than 121 million visitors each month and growing to over 50 million active customers.

Key requirements: You must offer products in the following categories: clothing, shoes, sportswear and equipment, and accessories. You should offer delivery and returns, provide a 100-day return policy.

Recent updates: Zalando’s GMV is predicted to reach €30 billion in 2025, with Germany and Poland contributing the largest portion of consumers. Their mobile app has become a particularly strong driver of sales, with over 80% of their 430 million monthly site views coming through mobile devices.

10. La Redoute

Who: La Redoute is one of the most popular online stores in France.

What: Mid-range and premium fashion and homeware, equally split between its own brands and external brands such as Adidas, Superdry, Mango and Petit Bateau.

When: Founded in 1837, La Redoute launched a marketplace in 2010.

Where: The company has a presence in France, as well as 26 other countries.

How much: A monthly subscription is €49.90 and there are no listing or one-off fees. Commissions are 8 to 20%.

Customer profile: La Redoute has over 11 million registered users, 90% of whom are female. Its core demographic is women aged 25 to 45.

Key requirements: La Redoute calls itself a curated marketplace and is highly selective when it comes to third-party sellers. Merchants must either be brand owners or authorized to sell the brand and, if selling more than €35,000 annually in France, must register for VAT with French tax authorities.

Recent update: La Redoute continues to focus on its sustainability initiatives and has expanded its eco-friendly product offerings, as sustainable shopping becomes increasingly important to European consumers.

11. Asos

Who: Asos is a rapidly growing internet fashion retailer. In 2010 it launched its own marketplace allowing boutiques, vintage collectors and designers to trade with customers from all over the world.

What: Mid-range fashion and vintage clothing. Over 800 small businesses now sell on the Asos Marketplace.

When: Asos was founded in 2000, but the Asos Marketplace launched in November 2010.

How much: £20 per month and 20% commission on every item sold. It’s free to list items and you can list as many as you want.

Customer profile: Asos is very popular with millennials and Gen Z shoppers and has a huge worldwide reach. It boasts 12.4 million active customers across 240 different countries and territories.

Key requirements: You must submit an application to sell on the Asos marketplace. For your application to be successful you need to be considered either; an emerging design talent, an innovative independent label and boutique, or a seller of the finest vintage selections.

Recent update: In January 2023, Asos partnered with non-full-price marketplace Secret Sales, expanding its offerings and providing an additional sales channel for excess inventory.

12. OnBuy

Who: OnBuy is the fastest-growing marketplace in the world, created by founder and CEO, Cas Paton.

What: Everything from electronics, home goods, books, DIY, tools, toys and games, and so much more.

When: Founded in November 2016.

Where: OnBuy is based in the UK and has expanded to multiple European countries.

How much: Selling with OnBuy starts at just £19 per month, with competitive selling fees and no listing fees. A package upgrade for an additional £20 per month is available with added benefits.

Key requirements: Businesses must have a PayPal business account (which can be set up during the sign-up process) and barcodes are required for products as OnBuy operates a catalogue system, although some products and categories are exempt.

Customer profile: OnBuy records just under 7 million visitors per month, shopping online for anything and everything.

Recent updates: OnBuy has continued its rapid growth trajectory, cementing its position as one of the leading eBay alternatives in the European market.

Final Thoughts – The European Marketplace Scene in 2025 Is Ripe for Expansion

European eCommerce is expected to reach US$900 billion by 2028, with marketplaces accounting for 42% of all eCommerce sales in Western Europe. With eCommerce contributing between 10.2 to 26.5% of retail sales – about half of its potential – there’s significant room for growth in these markets.

Choosing the right channel to further your reach into Europe is a great way to get in front of a new audience. While Amazon and eBay are excellent selling platforms, branching out to explore alternative European online marketplaces can ultimately improve your visibility and reach, which, in turn, will drive increased sales.

Understanding the unique requirements, customer profiles, and competitive advantages of each marketplace will help you make informed decisions about where to expand your eCommerce business in Europe. Whether you’re targeting fashion consumers through Zalando, Dutch shoppers via bol.com, or Polish customers on Allegro, there’s a European marketplace to fit your product niche and business goals.