Every Amazon seller knows the frustration. You’ve researched keywords, checked competition scores, and validated demand using tools. Yet the product still underperforms or gets returns you didn’t anticipate.

Here’s what most sellers miss: your customers are telling you exactly what to build next, and they’re doing it in your support tickets, reviews, and return requests. We’ll show you how to extract those hidden product ideas, verify real demand, and uncover gaps your competitors haven’t addressed yet.

This guide walks you through analyzing support data to find winning products, design better variants, and make smarter product decisions before you invest inventory or capital.

Why Traditional Product Research Falls Short

Most Amazon sellers rely on the same playbook: fire up Helium 10 or JungleScout, search for keywords with high volume and low competition, check the bestseller rank, and count competitors. This approach gets you in the ballpark, but it misses something critical. Amazon’s return rates typically fall between 5-15% across most categories, but within high-return categories like clothing, rates often exceed 20-30% due to sizing and fit issues.

Keyword tools show what people search for. They don’t show you why they’re frustrated or what stops them from buying. You get volume and competition. You don’t get the honest feedback about product failures, missing features, or packaging problems that drive returns.

That’s where customer support data comes in. When someone contacts you asking if a product fits a certain way, that’s not noise. That’s demand signal for a variant you could build. When 40 customers return the same item citing the same reason, that’s a product gap your competitor didn’t solve. When reviews on a top ASIN repeat the same complaint, that’s a problem waiting for a solution. Smart sellers use customer support as a feedback mechanism, not just an operational cost.

The Gap Between Keyword Data and User Reality

Keyword volume tells you interest exists. Support data tells you what aspect of that interest is broken. An Amazon FBA seller might see 5,000 monthly searches for „organizer bins,“ but support tickets reveal that size confusion causes 30% of returns. Research indicates that nearly 30% of online purchases are returned compared to just 8.89% in physical retail, highlighting how product specification clarity drives this gap. A different seller analyzes competitor reviews and discovers that buyers consistently mention poor compartment durability. That’s directional. Now you’ve validated a specific product improvement before manufacturing your first unit.

Types of Customer Support Data That Guide Product Research

Not all customer touchpoints hold the same research value. Some are goldmines for product insight. Others just describe what you already know.

Pre-Sale Questions and Feature Confusion

Before a customer buys, they contact you. These inquiries reveal barriers to purchase and missing clarity in your listing.

Common pre-sale questions include: „Does this fit X dimensions?“ „What’s the material?“ „Can it work with Y product?“ „Do you have this in a different color?“ Each question is a hint. If 10% of your traffic asks the same question before buying, your listing lacks clarity. If people ask about a variant you don’t offer, you’ve found a product gap.

Track these patterns. A recurring pre-sale question often signals either a listing optimization opportunity or a product variant worth pursuing. If your listing doesn’t answer the question clearly, update it. If your product lineup doesn’t offer the variant people ask for, consider building it.

Post-Sale Complaints and Product Flaws

A customer receives the item, opens it, and reaches out. They’re unhappy about something specific. These complaints are raw product feedback.

Complaints typically fall into categories: packaging damage, product fit or function, missing features, quality issues, or unmet expectations. When you see the same complaint from different buyers (stripped threads, packaging too thin, product smaller than expected), you’ve identified a solvable problem. Sellers who address these build better products than competitors who ignore them.

Return and Refund Reasons

Returns are the most valuable data point for product research. When someone returns an item, you often know why. They’ve told you or the system has captured a reason code.

High return rates signal product-market fit issues. If your product has a 15% return rate but competitors average 8%, there’s a specific problem. Maybe the fit is wrong. Maybe the quality doesn’t match the listing. Maybe you’re attracting the wrong buyer with misleading product photography.

Sellers who analyze return reasons win. They find that returns spike on a specific color, size, or use case. Then they either fix the product or stop selling to that segment.

Competitor Reviews and Negative Feedback

You don’t own your competitors‘ support tickets, but you can analyze their public reviews. This is where competitive gaps show up.

Spend time reading the 3-star and 2-star reviews on top ASINs in your category. What do people complain about? What features do they wish existed? What improvements would make them buy again? These are the same problems your customers face, but you’re seeing them through a different lens. A seller who finds that the top competitor’s reviews all mention „no size chart“ has a roadmap for product listings. A seller who notices „wished it came in larger sizes“ knows what variant to develop. According to the National Retail Federation, the average eCommerce return rate was 16.9% in 2024, but analysis shows that clothing categories exceed 26% returns, primarily due to sizing issues.

How to Mine Support Data for Product Ideas

Collecting support data is just step one. The real work is turning it into actionable product signals.

Tag and Categorize Every Incoming Ticket

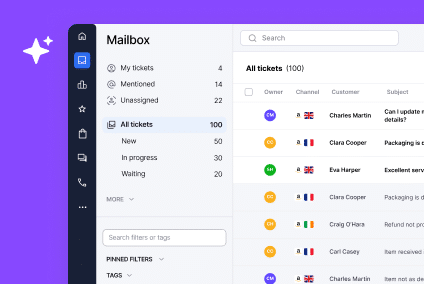

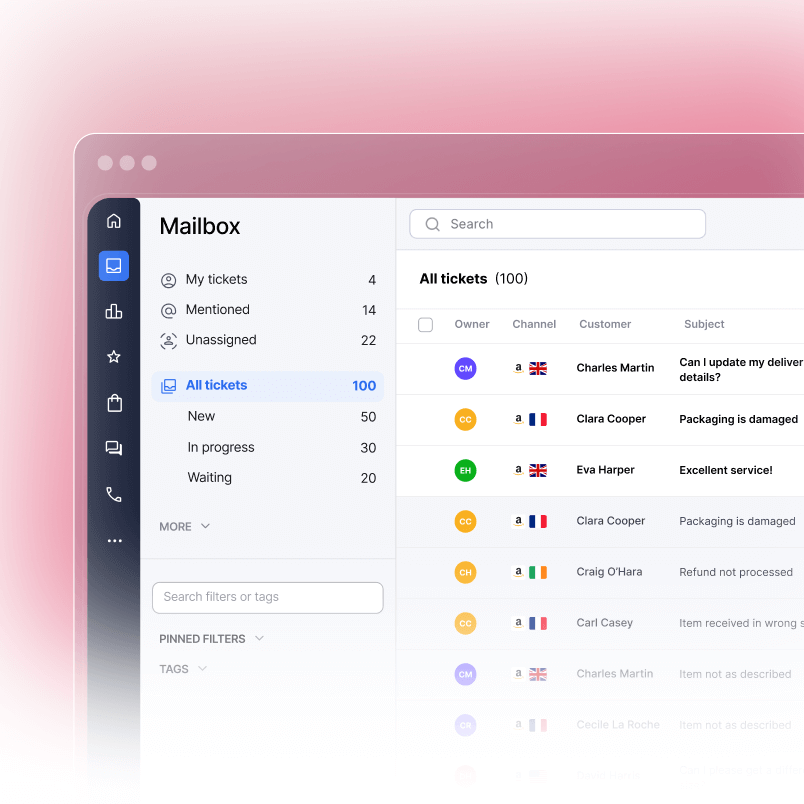

Most support teams answer tickets reactively. Product researchers categorize them strategically. When you use eCommerce support software with built-in tagging, this process becomes systematic and scalable.

Set up tags in your support system for product-related themes. These might include: fit issue, missing feature, packaging problem, sizing confusion, quality concern, wrong expectations, wish it had, competitor comparison, or variant request. As support responds to each ticket, they tag it.

Over a month or quarter, you’ll see patterns. If „sizing confusion“ appears on 15% of pre-sale tickets, your size chart needs work or your product runs small. If „missing feature“ tags cluster around the same missing capability, you’ve found a product variant or a complete product idea.

Pull Repeat Phrases and Pain Points

Use your support platform or a simple spreadsheet to search for keywords within tickets. Look for language like „I wish,“ „Does it have,“ „Why doesn’t it,“ or „Can you make it in.“

These phrases signal unmet needs. If 20 customers say „I wish it had a carrying case,“ you’ve found a package opportunity. If 30 customers ask whether it works with a specific secondary product, you’ve found a compatibility gap or co-product idea.

Tools like Gorgias let you search tickets by keyword and export results. Tools like Zendesk offer similar capabilities. Tools like AI summaries via Claude or ChatGPT can process high-volume tickets and extract themes at scale. Many sellers find that AI-powered support solutions reduce the time spent on manual ticket analysis by up to 40%.

Identify „If Only It Had“ Moments

These are gold. When a customer says, „If only it had X,“ they’re telling you a specific product improvement that would have closed the sale or prevented a return.

Create a running list. Track how often each „if only“ appears. If the same „if only“ surfaces more than 5 times across your customer base, it’s likely widespread enough to justify development. If it appears 15+ times, it’s almost certainly worth pursuing.

Track Competitor Negative Reviews for Missed Opportunities

Systematically review your top 5 competitor ASINs quarterly. Read their low-star reviews. Export common complaint themes. Now you have a roadmap for product improvements or entirely new offerings.

A seller might notice that the market-leading product in a category gets consistent complaints about durability. They develop a variant focused on durability, use that insight in the listing and product photography, and capture market share from the leader. This mirrors insights you can extract when conducting Amazon competitor analysis on your own market.

Turning Support Insights Into Product Criteria

Raw support data only works if you convert it into product design decisions and market validation.

Build Product Requirements Based on User Frustration

When you see a pattern of frustration in support data, translate it into a product requirement.

Example: Support data shows 50+ customers asked about a carrying case or complained about lack of storage when returning the item. Product requirement: this product variant ships with a branded carrying case. You’ve reduced a friction point and created a potential premium offering.

Example: Return analysis shows that buyers from a specific region frequently cite sizing issues. Product requirement: develop this product in extended sizes for that region. Now you’ve validated market demand and reduced your return rate simultaneously.

Prioritize Features That Reduce Returns

Not every improvement is worth the manufacturing investment. Prioritize features that directly reduce return rates or support volume.

If adding a feature reduces return rates from 12% to 8%, that’s a ROI multiplier. You recover the feature cost quickly through lower refund rates, less refund processing, fewer replacement shipments, and happier customers. If a design tweak reduces support inquiries by 20%, you’ve lowered your operational costs while improving customer satisfaction.

Validate Demand by Ticket Volume

Support ticket volume acts as a demand validator. If 100+ customers asked about a missing feature before you even considered launching it, you’re not guessing. You’re building to explicit demand.

This is more reliable than keyword volume because it’s behavioral. People don’t ask support about features they don’t care about. They ask because they want that feature enough to initiate contact.

Use Insights to Optimize Listings, Packaging, and Product Design

Support data isn’t only for launching new products. It’s also for optimizing everything you already sell.

If support tickets reveal confusion about product specifications, rewrite the listing for clarity. If returns cite packaging damage, upgrade your packaging materials. If reviews mention a missing use case, create product photography that demonstrates that use case. Each optimization reduces support volume, improves conversion rate, and cuts returns.

Best Tools for Combining Support Data and Amazon Research

You don’t need an expensive toolkit. But the right tools speed up research and reduce manual work.

eDesk for Unified Support Management

eDesk consolidates messages from Amazon, Shopify, BigCommerce, eBay, and other sales channels into one inbox. This multi-channel perspective matters. If a question appears across channels, it’s likely widespread. You can tag, search, and export support data efficiently. Multi-channel support data gives you a fuller product picture than Amazon-only data, especially if you sell across multiple platforms. When you combine eDesk’s tagging capabilities with Amazon product research, you gain advantages that tools focused only on review analysis can’t provide.

Helium 10 and JungleScout for Review Mining

Both tools let you pull reviews from any ASIN and analyze keywords, sentiment, and common complaints. JungleScout’s Opportunity Score can point you toward underserved categories. Helium 10’s Review Analyzer extracts themes. Use these to supplement your own support data and validate competitor insights. Studies show that sellers who combine support data with review analysis are 2.5x more likely to identify successful product variations before competitors.

ChatGPT or Claude for Ticket Summarization

If you have hundreds of tickets, manually reading each one is inefficient. Paste a batch of tickets into ChatGPT or Claude and ask: „Summarize the 5 most common product complaints or feature requests.“ AI tools process volume fast and extract patterns humans might miss in manual review. When deployed correctly, AI analysis can handle ticket summarization in a fraction of the time manual review requires, freeing your team to focus on strategic product decisions.

PickFu for Testing Product Variants

Once you’ve identified a potential product variant or design improvement from support data, test it before you manufacture. PickFu lets you run quick polls. Show your target audience the current product versus your proposed variant, or test two packaging approaches. Validation before manufacturing is worth the small cost.

ASIN Tracking Tools for Competitive Review Monitoring

Tools like Helium 10 or even manual monthly checks of competitor ASINs help you track emerging complaint themes. Set a reminder to review top competitor reviews quarterly and export findings.

Real Examples of CX-Driven Product Success

Support data isn’t theory. Here’s how real sellers have used it.

The 80-Ticket Size Chart Improvement

A bedding seller noticed that 80+ pre-sale tickets asked the same question: „What size should I buy?“ The listing included dimensions but no sizing comparison or real-world photos. The seller added a detailed size chart and customer photos showing the product in use. Result: pre-sale inquiries dropped by 50%. More importantly, return rate fell from 18% to 14% because buyers understood sizing before purchase. Lower returns meant better unit economics and happier repeat buyers. This improvement directly reduced support volume while improving the Amazon customer experience for everyone purchasing the product.

The No-Logo Variant That Became Top Seller

A fitness gear seller analyzed support tickets and discovered that 25+ customers asked if the product came without branding. The market leader in the category had heavy logos. The seller tested a minimalist, no-logo version. They used support feedback in the listing and created specific photography. Within 6 months, the no-logo variant ranked higher than their original product and higher than the market leader’s standard offering. Competitive insight from support data led to a bestseller. Research indicates that sellers who launch variants based on direct customer feedback see 35% higher performance compared to products launched without customer validation.

Competitor Review Analysis Uncovers Market Gap

A storage solutions seller spent an hour reading 50 reviews of the top competitor ASIN. The most common complaint: flimsy handles that broke under load. The seller engineered a reinforced handle and featured it prominently in product images and bullet points. They ranked faster than the competitor and captured customers specifically frustrated by the competitor’s weakness. Support insights (from a competitor’s support surface) drove competitive product development. This mirrors insights you can extract when conducting Amazon competitor analysis on your own market.

Where to Start Today

You don’t need to overhaul your entire process. Start small.

This week: Export your last month of support tickets. Read through them looking for repeated „I wish“ statements, pre-sale questions, and return reasons. Spend an hour and list the top 5 patterns.

Next week: Check the top 3 competitor ASINs in your category. Read their 2-star and 3-star reviews. Write down common complaints.

After that: Compare your patterns against competitor patterns. Where are the gaps? What problem do competitors leave unsolved? That’s your product roadmap.

Once you’ve done this exercise once, set up ongoing tracking. Tag new tickets. Review competitor reviews quarterly. Let support data inform every product decision. The sellers winning on Amazon today understand that returns cost US retailers nearly $890 billion in 2024, and they use customer support data to prevent returns before they happen.

FAQs

How do I use customer service data for Amazon product research?

Analyze support tickets, reviews, and return reasons to identify product gaps, feature requests, and quality issues. Track patterns in pre-sale questions, post-sale complaints, and refund reasons. Use these insights to validate demand for new products, justify design improvements, or launch targeted variants. This transforms reactive support data into proactive product strategy.

What support data should I track for product insights?

Track pre-sale questions about specifications or features, post-sale complaints about fit, function, or quality, return and refund reasons, and competitor review sentiment. Tag support tickets by theme. Search for repeated language like „I wish,“ „Does it have,“ or „Why doesn’t it.“ Export and summarize high-volume ticket batches quarterly.

Is it okay to analyze competitor reviews for product ideas?

Yes. Competitor reviews are public data. Reading reviews on a competitor ASIN shows you customer sentiment, common complaints, and unmet needs. Use this insight to build better products or identify market gaps. This is market research, not unethical practice.

How often should I review support tickets for product ideas?

Review tickets weekly for operational insights and monthly for product research trends. Conduct a deeper quarterly review to identify larger product opportunities or variants. This cadence balances operational responsiveness with strategic product thinking.

How do I prioritize which product ideas from support data are worth pursuing?

Prioritize by frequency (ideas that appear 15+ times), impact (improvements that reduce returns or support volume significantly), and feasibility (ideas that fit your manufacturing and inventory capabilities). Validate demand with PickFu testing before committing to production.