For brands selling Home & Garden products, online marketplaces are the primary battleground for customer acquisition. However, the sheer number of platforms, combined with regional differences in consumer behavior and logistics, can make scaling a daunting challenge.

To help you navigate this complex landscape, we’ve broken down the major online marketplaces across the United States and Europe, highlighting their key features, buyer scale, and seller pros and cons.

The US Landscape: Giants and Niche Specialists

The US market is dominated by retail giants, but several niche and category-specific platforms offer highly engaged customer bases for Home & Garden sellers. Understanding the differences between these platforms is key to maximizing reach and profit margin.

1. Amazon

- Buyer Scale: 310M+ active users worldwide (with a massive US share).

- Key Features: Offers massive reach, streamlined logistics via Fulfillment by Amazon (FBA), and extensive retail media advertising options. Best for maximizing volume.

- Seller Pros: Unmatched scale, consumer trust via Prime, and robust logistics infrastructure.

- Seller Cons: High fees and intense competition; requires strict adherence to performance rules.

2. Walmart Marketplace

- Buyer Scale: Approximately 480-500M monthly site visits, with over 120M unique visitors per month.

- Key Features: A strong general goods platform that includes Home and Garden. Supported by Walmart Fulfillment Services (WFS) and integrates the store and app experience.

- Seller Pros: Lower seller crowd compared to Amazon, strong omnichannel presence.

- Seller Cons: Requires invite scrutiny; categories and price checks are common; fees vary by category.

3. eBay

- Buyer Scale: Approximately 134M active buyers globally.

- Key Features: Offers sales of new, used, and refurbished goods, utilizing both auction and fixed-price listing formats.

- Seller Pros: Huge existing buyer base and flexible listing options to suit different inventory types.

- Seller Cons: Often requires significant advertising spend to gain visibility; the fee structure can be complex.

4. Etsy

- Buyer Scale: Approximately 95M active buyers (as of 2024).

- Key Features: Highly specialized in handmade, vintage, and unique home décor items.

- Seller Pros: Attracts high-intent, loyal buyers looking for personalized and distinctive products.

- Seller Cons: Scope for mass-market brands is limited; involves transaction and listing fees.

5. Wayfair

- Buyer Scale: Approximately 21.0-21.1M active customers.

- Key Features: A home-only platform that typically operates on a supplier or Drop-Ship Fulfillment (DFM) model rather than a standard commission-based marketplace.

- Seller Pros: Strong category focus and specialized logistics programs for furniture and large goods.

- Seller Cons: Pricing involves a margin/wholesale model rather than classic 3P commission; requires high merchandising standards.

6. Home Depot (Online Marketplace)

- Buyer Scale: Approximately 181-250M monthly visits to the main site.

- Key Features: Targets DIY and professional customers, with some third-party (3P) assortment available online.

- Seller Pros: Benefits from the brand’s immense trust; offers store pickup options for certain products.

- Seller Cons: Marketplace access is highly curated; requires a strong category fit with the DIY and Pro focus.

7. Lowe’s Marketplace

- Buyer Scale: Approximately 85.72M monthly visits

- Key Features: Focuses on DIY/Home. This is a newer program, scaling up via the Mirakl platform, launched in late 2024.

- Seller Pros: Offers an early-mover advantage for sellers who are curated and accepted onto the platform.

- Seller Cons: The program is still in its early stages and actively ramping up its selection.

8. Houzz (Houzz Shop)

- Buyer Scale: Approximately 40–65M monthly users

- Key Features: Blends home inspiration with commerce, attracting design-led shoppers.

- Seller Pros: High-intent design traffic; sales driven by visual content and trend inspiration.

- Seller Cons: Smaller retail GMV compared to general marketplaces; adherence to high curation standards required.

9. Target Plus

- Buyer Scale: Approximately 165–170M monthly visits; the marketplace is invite-only.

- Key Features: A highly curated third-party (3P) component nested within Target.com.

- Seller Pros: Benefits from the strong Target brand halo; less competition at the SKU level.

- Seller Cons: Invitation is required for entry; limited categories and lighter data tools compared to large rivals.

10. 1stDibs (Home, Art, Luxury)

- Buyer Scale: Approximately 64K active buyers; 7.0M registered users.

- Key Features: Focuses on high-Average Order Value (AOV) furniture, décor, and vintage items.

- Seller Pros: Access to a premium, high-net-worth audience; rigorous curation maintains quality.

- Seller Cons: Highly niche platform; rigorous onboarding and high commission rates apply.

11. Chairish (Vintage/Home)

- Key Features: A curated marketplace focused on vintage and high-end home décor and furniture.

- Seller Pros: Attracts a highly design-conscious audience with high purchase intent. Offers logistics assistance for bulky items.

- Seller Cons: Niche audience; complexity involved in shipping large, one-of-a-kind items.

12. AptDeco (Used Furniture)

- Buyer Scale: 500K+ active users (Peer-to-Peer resale focus).

- Key Features: Specializes in local delivery and resale of furniture.

- Seller Pros: Provides logistics assistance; appeals to environmentally and price-savvy buyers.

- Seller Cons: Coverage is typically regional; sales are limited to resale price points.

13. Facebook Marketplace (C2C; some B2C)

- Buyer Scale: Approximately 491M monthly shoppers estimated; over 1B MAU cited on Marketplace.

- Key Features: Originally C2C, but increasingly supports B2C, often for local pickup of large goods.

- Seller Pros: Massive reach; zero listing fee for local sales.

- Seller Cons: Less brand control; buyer protection and shipping logistics can vary widely.

14. TikTok Shop (US)

- Buyer Scale: 150M+ U.S. users. An estimated 47.2M social media shoppers in 2024, projected to grow to 55.6M by 2027.

- Key Features: Focuses on live and social commerce, driving impulse home buys.

- Seller Pros: Provides exceptional creator amplification and is experiencing very fast growth in GMV.

- Seller Cons: Volatile platform policies and significant ongoing content creation workload required.

US Fee Notes

It is essential to factor in marketplace fees when calculating profitability. Typical referral/transaction rates for Home & Garden products include:

- Amazon Home & Kitchen: Approximately 15% (furniture is 15% up to $200, then 10%).

- Walmart Home/Garden: Approximately 15%.

- eBay: Generally category-based, often around 13-15% up to a certain threshold.

- Etsy: A 6.5% transaction fee plus a $0.20 listing fee, in addition to payment processing fees.

- Target Plus is an invite-only platform.

The European Landscape: Fragmentation and Specialization

The European landscape is more fragmented, with strong regional players dominating specific countries like Germany, France, and the Netherlands. Pan-European expansion often requires a multi-marketplace strategy due to varying compliance and consumer preferences.

1. Amazon (EU Stores)

- Buyer Scale: Estimated 1.2 Billion monthly visits across top EU markets.

- Key Features: Provides pan-EU reach and supports cross-border fulfillment through programs like Fulfillment by Amazon (FBA) and European Fulfillment Network (EFS).

- Seller Pros: Massive scale and established programs like PAN-EU FBA simplify logistics.

- Seller Cons: Compliance requirements and fee structures vary significantly by country (e.g., VAT, WEEE).

2. ManoMano

- Region: France, Spain, Italy, Germany, and the UK.

- Buyer Scale: Approximately 7M active customers and 50M monthly visits.

- Key Features: A dedicated specialist for DIY, Garden, and Home improvement products. It also operates a separate Pro marketplace.

- Seller Pros: Benefits from a highly targeted category focus and high purchase intent.

- Seller Cons: Commission rates can be high (approximately 15-25%), often accompanied by a monthly subscription fee.

3. OTTO

- Region: Germany (DE).

- Buyer Scale: Approximately 12.2M active customers.

- Key Features: A large generalist marketplace with a notably strong presence in the Home category.

- Seller Pros: High brand trust within Germany and strong retail media advertising options.

- Seller Cons: The monthly base fee has recently increased; commission is typically 7-18% plus a payment fee.

4. bol

- Region: Netherlands (NL) and Belgium (BE).

- Buyer Scale: Approximately 13.7M active customers.

- Key Features: The dominant generalist marketplace in the Netherlands and Belgium. Offers Fulfillment by bol (FBB).

- Seller Pros: Achieves local dominance and provides effective fulfillment options.

- Seller Cons: Sellers often require a local entity to operate; commissions are category-based.

5. Cdiscount

- Region: France (FR).

- Buyer Scale: Approximately 20M unique visitors per month; 9M active customers.

- Key Features: A French generalist platform with a strong assortment in Home goods.

- Seller Pros: Strong domestic reach within France and effective advertising tools.

- Seller Cons: Requires a monthly subscription of €39.99, plus commissions ranging from 5-20%.

6. B&Q Marketplace

- Region: UK.

- Buyer Scale: Approximately 320M annual visits (around 26-27M/mo) to diy.com.

- Key Features: A major UK specialist for DIY, garden, and outdoor products. The marketplace is powered by Mirakl.

- Seller Pros: Strong UK brand recognition and trust; is actively developing its Click & Collect capabilities for marketplace sellers.

- Seller Cons: UK-centric focus; a monthly subscription fee of $\text{£}39$ applies, plus commission.

7. Allegro

- Region: Poland (PL) and Central and Eastern Europe (CEE).

- Buyer Scale: Approximately 21M active buyers across the group.

- Key Features: The market leader in Poland, covering general goods with strong Home categories.

- Seller Pros: Clear leadership in the CEE region and multiple logistics options for cross-border trade.

- Seller Cons: Requires localization of listings and customer service; the fee grid varies.

8. home24

- Region: Germany (DE) + broader EU presence.

- Buyer Scale: Approximately 4.2M monthly visits (marketplace).

- Key Features: A highly curated marketplace specializing in Home & Living products.

- Seller Pros: Strong category focus and dedicated seller storefronts within a niche.

- Seller Cons: Smaller scale compared to generalists like Amazon or OTTO.

9. Galaxus/Digitec

- Region: Switzerland (CH) and Germany (DE).

- Buyer Scale: Approximately 27M monthly visits; over 4M active users (CH sites).

- Key Features: A generalist marketplace with a strong emphasis on Home products, known for technology expertise.

- Seller Pros: High trust among the premium Swiss market; strong growth in Germany.

- Seller Cons: Swiss duties and logistics can be complex; the German platform is still building scale.

10. Maisons du Monde (Marketplace)

- Region: France (FR) + EU.

- Buyer Scale: Approximately 7.5M active customers (retailer base).

- Key Features: A highly curated platform focusing on Home décor and furniture with a strong lifestyle brand positioning.

- Seller Pros: Access to a design-focused, loyal customer base.

- Seller Cons: It is a closed and curated platform with strict presentation and quality standards.

Understanding European Fee Structures

European marketplaces often combine fees:

- Monthly Subscriptions: Platforms like ManoMano and Cdiscount typically charge a monthly base fee in addition to commissions.

- Commission Ranges: Commissions are highly category-dependent, ranging from roughly 5% to 25% across different platforms.

- OTTO: Now charges a base fee of around €99.90 per month.

Choosing Your Platform: Strategy by Objective

| Objective | Recommended Marketplaces | Key Strategy Note |

| Maximum Reach & Volume | Amazon, Walmart, eBay (US); Amazon EU (EU) | Prioritize logistics programs like FBA/WFS to secure fast shipping badging. |

| Targeting Home-Only Buyers | Wayfair, Houzz (US); ManoMano (DIY/garden), OTTO (DE) (EU) | Focus on platforms that attract high-intent, category-focused shoppers. |

| UK Focus | B&Q Marketplace (DIY/garden), eBay UK | Leverage local brands with existing consumer trust in the UK market. |

| CEE (Central/Eastern Europe) Entry | Allegro (Poland + CEE network) | Allegro is the essential starting point for this specific region. |

| Premium/Vintage/Luxury | 1stDibs, Chairish (US); Maisons du Monde marketplace (EU) | Focus on platforms that support higher Average Order Value (AOV) and have curated audiences. |

Key Considerations for Global eCommerce Expansion

When mapping out your Home & Garden strategy, remember that not all platforms operate as a traditional commission-based marketplace:

- Curated Models: Retailers like Wayfair, Target Plus, and Home Depot/Lowe’s run highly curated or supplier/wholesale models. This means the onboarding process, pricing negotiations, and margin economics differ significantly from open third-party (3P) marketplaces.

- Metrics Definitions: Buyer counts and traffic figures can vary widely based on the definition used (e.g., active buyers vs. monthly visitors). Always use the most recent, credible figures to accurately size up your potential market.

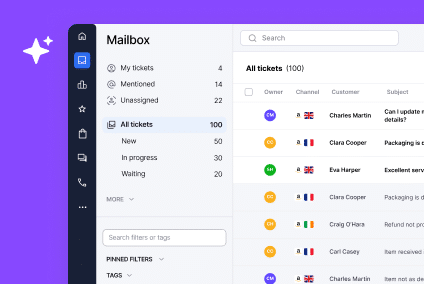

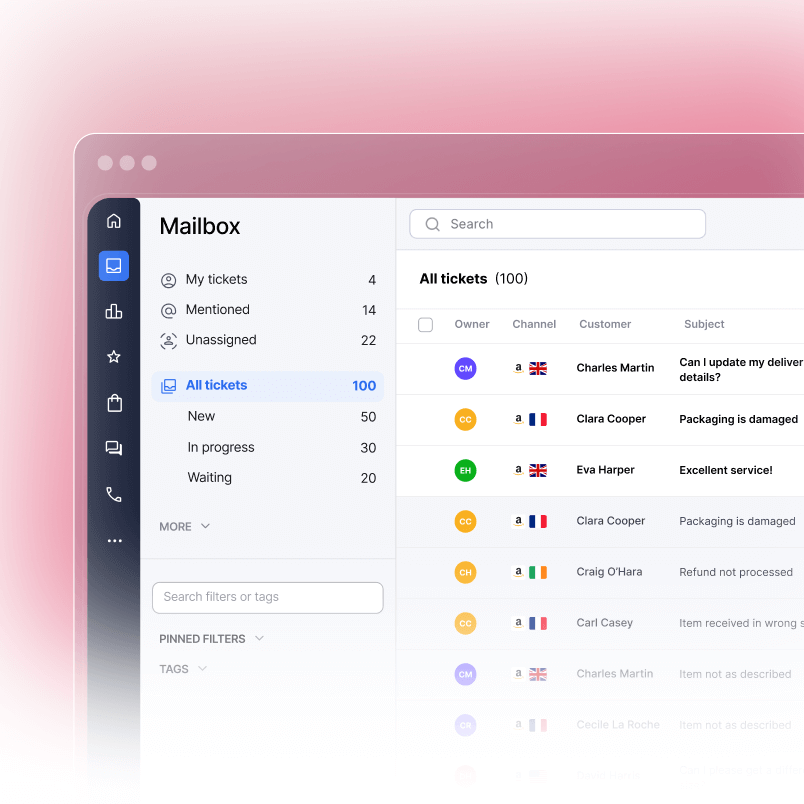

- Customer Service Scaling: Regardless of the platform chosen, regional expansion multiplies customer service complexity (language, time zones, local refund policies). Utilizing an efficient eCommerce helpdesk solution is crucial for managing inquiries across a multi-marketplace portfolio without losing speed or quality.

Understanding these regional nuances and platform dynamics is critical for sellers looking to scale their customer service and sales operations across the Home & Garden vertical.

If you need help managing customer support, streamlining orders, or integrating multiple marketplaces into one platform, book a demo with eDesk. Our team can help you simplify multichannel selling and deliver exceptional service, wherever you sell.