The online beauty industry is experiencing massive growth. In the United States alone, eCommerce sales for beauty are projected to hit approximately $86 billion in 2023, with forecasts showing a rise to over $94 billion by 2026. Globally, the health and beauty category is predicted to reach an astounding $449.6 billion in eCommerce sales by 2027.

For beauty brands—whether they focus on skincare, haircare, grooming, fragrances, or period care—the opportunities are vast. To inspire your next strategy, we’ve analyzed the successful beauty eCommerce sites, looking at the tools, approaches, missions, and products that helped them achieve major milestones. The visitor data offers a snapshot of their current reach and online engagement.

The US Landscape: Prestige, Mass-Market, and Social Commerce

The US market is dominated by the battle between prestige (Sephora) and mass-market (Ulta, Target) retailers, all while generalists and social platforms compete for impulse and everyday purchases.

1. Amazon

- Buyer Scale: 310M+ active users worldwide (massive US share).

- Key Features: Offers massive reach, FBA logistics, strong in mass-market and growing Premium Beauty.

- Seller Pros: Unmatched volume; consumer trust via Prime; FBA simplifies logistics.

- Seller Cons: Intense competition; authenticity and brand protection concerns; high category fees.

2. Sephora (Marketplace)

- Buyer Scale: $2.59B Net Revenue (2022); 14M+ Beauty Insider members (US).

- Key Features: Prestige-focused; high-end skincare, makeup, and fragrance; highly curated assortment.

- Seller Pros: Strong brand halo and trust; high Average Order Value (AOV); access to loyal Beauty Insider customers.

- Seller Cons: Highly selective/invite-only; strict merchandising and brand standards; focuses on prestige price points.

3. Ulta Beauty (Marketplace)

- Buyer Scale: 40M+ Ultamate Rewards members; large US store footprint.

- Key Features: Mass to Prestige product mix («All Things Beauty»); strong salon integration.

- Seller Pros: Massive, diverse loyalty base; expanding assortment via new Marketplace; strong omnichannel strategy.

- Seller Cons: Newer marketplace program (scaling); highly competitive with Ulta’s own private labels.

4. Target Plus

- Buyer Scale: ~165–170M Target.com monthly visits; the marketplace is invite-only.

- Key Features: Highly curated third-party component; often integrates with in-store Ulta Beauty at Target shops.

- Seller Pros: Strong retail partnership halo; less direct competition; high credibility.

- Seller Cons: Invitation required for entry; highly limited categories and slower onboarding process.

5. Walmart Marketplace

- Buyer Scale: ~480–500M monthly site visits; 120M+ unique visitors/mo.

- Key Features: Strong in mass-market and value beauty; expanding digital brands.

- Seller Pros: High volume potential for value-driven or mass-market items; lower fees than Amazon.

- Seller Cons: Lower perceived brand prestige; intense focus on competitive pricing.

6. TikTok Shop (US)

- Buyer Scale: ~47M social media shoppers (2024 est.); ~79.3% of sales were Health & Beauty (2024).

- Key Features: Live/social commerce; focuses on trending, viral, and impulse-buy beauty; low friction sales.

- Seller Pros: Exceptional for creator-led viral marketing; very fast GMV growth; low 6% referral fee on most categories (as of late 2024).

- Seller Cons: Volatile policies; high content creation workload; logistics can be challenging.

7. eBay

- Buyer Scale: ~134M active buyers globally.

- Key Features: New, used, excess, and refurbished beauty; strong in fragrance and discontinued items.

- Seller Pros: Flexibility for unique inventory (excess/discontinued); seller retains control over pricing.

- Seller Cons: Perception issues around authenticity; requires significant advertising for visibility.

US Fee Notes

- Amazon Beauty: Referral fees typically range from 8% to 15%, with Premium Beauty often at the lower end for high-value items, or a minimum fee per item.

- TikTok Shop: Uses a unified referral fee that includes commission and processing. The rate for most Beauty and Personal Care items is currently 6% (as of late 2024), significantly lower than most competitors.

- Curated Platforms (Sephora/Ulta/Target Plus): These platforms operate on custom, negotiated margin models or commission rates which are not publicly standardized.

The European Landscape: Regional Leaders and Pan-European Specialists

The European market is dominated by pan-European generalists and regional category-killers, with a strong emphasis on professional and pharmaceutical-grade skincare.

1. Amazon (EU Stores)

- Region: Pan-EU.

- Buyer Scale: Estimated 1.2 Billion monthly visits across top EU markets.

- Key Features: Pan-EU reach; FBA supports cross-border fulfillment across major markets (DE, UK, FR).

- Seller Pros: Massive scale; existing infrastructure simplifies multi-country logistics and VAT.

- Seller Cons: High compliance requirements (packaging, WEEE); intense pricing pressure across borders.

2. Zalando

- Region: Pan-EU (DE, FR, UK, etc.)

- Buyer Scale: 51M+ active customers across 25 European markets.

- Key Features: Leading European fashion and lifestyle platform; strong Beauty & Cosmetics category (Zalando Partner Program).

- Seller Pros: High customer loyalty in key markets (especially DE); strong fashion-forward audience.

- Seller Cons: Primary focus remains fashion; commission structure is generally higher than generalists.

3. Douglas

- Region: DE + 20+ countries (Online).

- Buyer Scale: Global web traffic ~8M monthly users (leading premium EU retailer).

- Key Features: Dominant premium beauty and fragrance retailer in Germany and Southern Europe; strong omnichannel presence.

- Seller Pros: High brand credibility and trust for prestige products; access to an affluent customer base.

- Seller Cons: Highly selective; requires high presentation standards; operates on curated contracts or negotiated terms.

4. Notino

- Region: Czech-based; 24 European countries.

- Key Features: Digital-native; focuses on a massive range of fragrance, mass, and niche beauty with competitive pricing.

- Seller Pros: Strong e-commerce expertise and fulfillment for cross-border European delivery.

- Seller Cons: High volume/value focus means intense pricing competition in some categories.

5. LOOKFANTASTIC

- Region: UK-based; Global shipping.

- Buyer Scale: ~7.3M monthly sessions (Aug 2025); strong UK presence.

- Key Features: Specialist in Haircare, Skincare, and UK/US brand imports; owned by THG (The Hut Group).

- Seller Pros: Strong UK and international market reach; dedicated beauty audience; good promotional support.

- Seller Cons: High competition in sponsored placements; often a retailer/marketplace hybrid model.

6. Allegro

- Region: Poland (PL) + CEE.

- Buyer Scale: ~21M active buyers across the group.

- Key Features: Market leader in Poland; generalist with robust mass-market cosmetics category.

- Seller Pros: Clear leadership in the CEE region; multiple logistics options for cross-border trade.

- Seller Cons: Requires strong localization (Polish listings); high category commission in some tiers.

7. bol

- Region: Netherlands (NL) and Belgium (BE).

- Buyer Scale: ~13.7M active customers.

- Key Features: Dominant generalist marketplace in Benelux; growing Personal Care/Beauty category.

- Seller Pros: Local market dominance; high customer loyalty in the Benelux region.

- Seller Cons: Sellers often require a local entity to operate; commission rates are category-based.

European Fee Notes

- Allegro/bol: Commissions are category-dependent, often ranging from 5% to 15% for Personal Care, in addition to any potential base or fulfillment fees.

Choosing Your Platform: Strategy by Objective

| Objective | Recommended Marketplaces (US & EU) | Key Strategy Note |

| Maximum Volume/Mass-Market | Amazon, Walmart (US); Amazon EU, Allegro (EU) | Focus on high-volume, lower-margin staples and leverage FBA/Fulfillment programs. |

| Prestige/High-AOV Focus | Sephora, Douglas (US/EU) | Focus on curated product listings, high-quality content, and luxury brand storytelling. |

| Trend & Viral Growth | TikTok Shop (US/UK) | Requires significant investment in content creation (UGC, short-form video) to drive impulse buys. Offers low introductory fees. |

| Focus on Loyalty Customers | Ulta Beauty, Target Plus (US) | Tap into the massive existing loyalty program bases (Ultamate, Beauty Insider) for repeat purchases. |

| UK/Specialist Beauty | LOOKFANTASTIC (UK/Global) | Utilize dedicated specialist platforms with existing high-intent beauty audiences. |

Key Considerations for Global eCommerce Expansion

When mapping out your Beauty & Cosmetics strategy, keep the following in mind:

- Social Commerce Dominance: Platforms like TikTok Shop are quickly becoming primary discovery and conversion channels, especially for makeup and skincare. Its low referral fee is a massive incentive but requires a heavy investment in live shopping and creator collaborations.

- Curated vs. Open: Prestige retailers like Sephora and Douglas will give your brand a halo effect, but they operate on highly curated, invite-only models with strict quality and presentation standards.

- Authenticity: Given the prevalence of counterfeits in beauty, platforms like Amazon and eBay require robust strategies to protect your brand and ensure customer trust. Selling through curated channels often alleviates this concern.

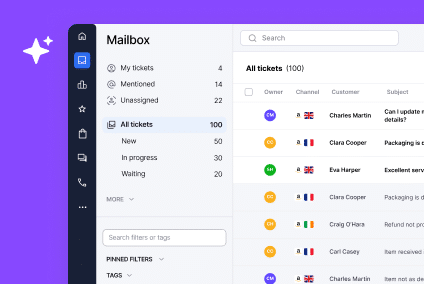

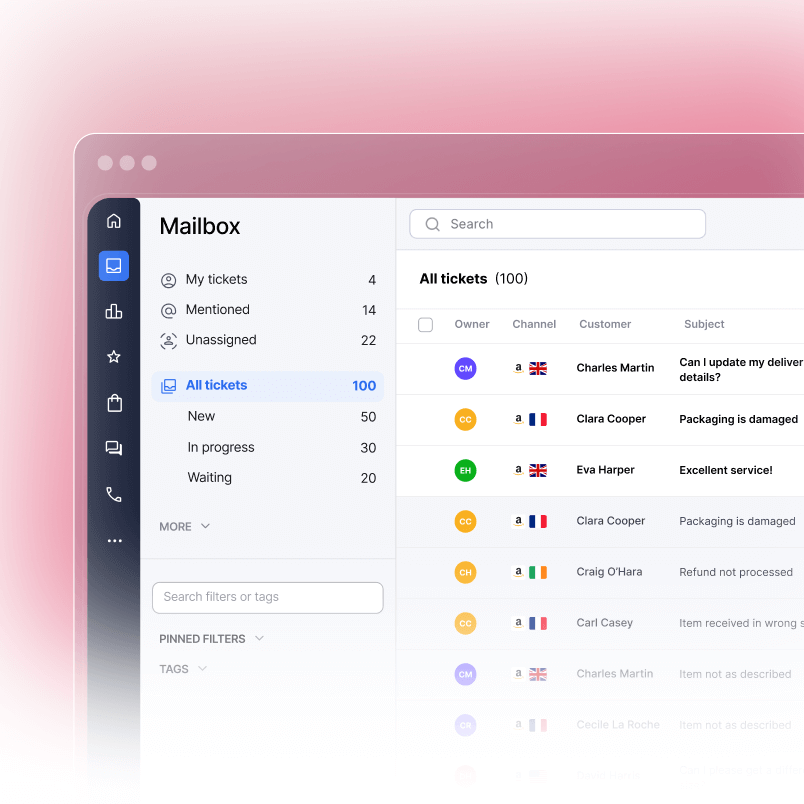

- Customer Service Scaling: Expanding across multiple geographies and platforms—from Amazon to TikTok—multiplies customer service complexity (language, return policies, platform-specific inquiries). Utilizing an efficient eCommerce helpdesk solution that centralizes tickets is non-negotiable for managing this volume and complexity without sacrificing service speed.

Need help managing your online food orders or customer support across multiple marketplaces? Book a demo with eDesk today and discover how we can help you centralize messages, streamline operations, and grow your business with less effort.