The Fashion and Apparel market is defined by rapid trends, high return rates, and a split between massive generalist platforms and curated, category-specific specialists. Scaling a fashion brand requires choosing platforms that align with your price point, aesthetic, and inventory model (new, vintage, or luxury).

Here’s a hand-picked list of the leading fashion marketplaces for eCommerce sellers in 2025, each offering distinct advantages, target audiences, and operational expectations.

We hope you find it useful, and it helps you pick the right places to sell for maximum success.

The US Landscape: Mass, Resale, and Social Commerce

The US market features strong generalists, a robust resale ecosystem, and the explosive growth of social commerce.

1. Amazon Fashion

- Buyer Scale: 310M+ active users worldwide (massive US share).

- Key Features: Offers massive reach, streamlined logistics via FBA, and a wide price range from mass-market to premium apparel.

- Seller Pros: Unmatched volume and visibility; Prime loyalty; FBA logistics handle high return volumes.

- Seller Cons: Intense competition; requires high investment in advertising; apparel category fees can be high.

2. Walmart Marketplace

- Buyer Scale: ~480–500M monthly site visits; 120M+ unique visitors/mo.

- Key Features: Strong generalist platform focused on mass-market and value-driven apparel and accessories.

- Seller Pros: High volume potential for affordable items; lower seller competition compared to Amazon; strong omnichannel presence.

- Seller Cons: Lower perceived brand prestige; intense focus on competitive, everyday low pricing.

3. TikTok Shop (US)

- Buyer Scale: ~47M social media shoppers (2024 est.); on a base of 150M+ US users.

- Key Features: Live and social commerce; focuses on trending, viral, and impulse-buy fashion; low-friction sales and creator-led marketing.

- Seller Pros: Explosive GMV growth; exceptional virality potential; low introductory referral fee (currently ~6%) for most apparel categories.

- Seller Cons: Volatile trends; high content creation workload; requires managing creator collaborations.

4. eBay Fashion

- Buyer Scale: ~134M active buyers globally; especially strong in the UK and DE.

- Key Features: Dominant in resale, vintage, overstock, and branded surplus apparel; supports both auction and fixed-price listings.

- Seller Pros: Flexibility for unique or discontinued inventory; low entry barriers; international buyer base for niche items.

- Seller Cons: Often seen as a discount channel; requires significant advertising to stand out from individual sellers.

5. Poshmark

- Buyer Scale: ~50M monthly visits (US); focused community of repeat buyers.

- Key Features: Leading social resale platform in the US, based on seller “closets” and community interaction.

- Seller Pros: Strong, highly engaged community; high visibility for branded items; seller handles fulfillment (no inventory storage fees).

- Seller Cons: High commission rate (20% for sales over $15); platform relies heavily on seller time commitment for listing “sharing.”

6. Etsy

- Buyer Scale: ~95M active buyers (as of 2024).

- Key Features: Specialized in handmade, vintage, custom, and artisanal clothing and accessories.

- Seller Pros: Attracts high-intent buyers seeking unique, custom, or sustainable fashion.

- Seller Cons: Niche audience outside of specific categories; high competition within handmade jewelry and accessories.

US Fee Notes

- Amazon Apparel: Referral fees typically 17%, with a lower rate for high-value watches and jewelry.

- Poshmark: Flat 20% commission on all sales over $15.

- TikTok Shop: Currently uses a low introductory referral fee of 6% for most apparel categories (excluding payment processing and taxes), which is highly competitive.

The European Landscape: Category Killers and Pan-European Reach

The European market is dominated by fashion specialists like Zalando and ASOS, which have established strong cross-border logistics and brand trust.

1. Zalando

- Region: Pan-EU (DE, FR, NL, etc.)

- Buyer Scale: 51M+ active customers across 25 European markets.

- Key Features: Europe’s largest online fashion and lifestyle platform; curated mix of mass and premium brands; strong focus on sustainability.

- Seller Pros: Unmatched scale in Europe; established logistics (Zalando Fulfillment Solutions); trusted by consumers for returns.

- Seller Cons: High commission structure (5-25%); strict brand selection process and mandatory returns policy (100 days).

2. ASOS Marketplace

- Region: Global, with strong UK/EU base.

- Buyer Scale: ~63M monthly visits (ASOS site); over 18M active customers globally.

- Key Features: Focuses on independent labels, vintage, and boutique fashion; attracts a young, trend-conscious demographic.

- Seller Pros: Access to a global, engaged Gen Z/Millennial audience; strong brand association with fashion trends.

- Seller Cons: Sellers must operate as an independent “boutique” with a subscription fee; 10% commission applies on sales.

3. Farfetch

- Region: Global, focus on high-spending customers.

- Buyer Scale: Over 2M high-value customers; known for high Average Order Value (AOV).

- Key Features: Leading platform for luxury fashion from global boutiques and brands.

- Seller Pros: Access to an affluent, global audience; strong brand control and presentation for luxury items.

- Seller Cons: High commission rates (25-33%) and strict curation process; requires high-end inventory.

4. Vinted

- Region: Pan-EU (FR, DE, UK, etc.).

- Buyer Scale: ~28M monthly visitors (EU); massive community-driven resale.

- Key Features: Leading European second-hand fashion platform; C2C focus with low barrier to entry.

- Seller Pros: 0% seller fees (buyer pays all protection fees); rapid growth in circular fashion; easy listing process.

- Seller Cons: Low price points; seller handles individual shipping; brand control is nonexistent.

5. OTTO

- Region: Germany (DE).

- Buyer Scale: Over 9M active customers; ~54M monthly visits (DE).

- Key Features: Germany’s second-largest online retailer; strong presence in fashion and lifestyle products.

- Seller Pros: High brand trust in the critical German market; low competition compared to Amazon DE.

- Seller Cons: High one-time registration fee (up to €10,000); requires German translation and fulfillment experience.

European Fee Notes

- Zalando: 5-25% commission (category-dependent).

- ASOS Marketplace: 10% commission plus a monthly boutique subscription fee.

- Farfetch: High commission of 25-33% due to its luxury focus and white-glove service.

- Vinted: 0% seller fee; all transaction/protection costs are passed to the buyer.

Choosing Your Platform: Strategy by Objective

| Objective | Recommended Marketplaces (US & EU) | Key Strategy Note |

| Maximum Volume/Mass-Market | Amazon, Walmart (US); Amazon EU, OTTO (DE) | Focus on high-volume staples, optimizing listings for search and price. |

| Luxury/Premium Focus | Farfetch (Global); Zalando (Premium tier) | Prioritize brand storytelling, high-quality photography, and curated channels. |

| Trend & Impulse Growth | TikTok Shop (US/UK) | Essential for high-turnover fashion; heavily utilize video content and creator marketing. |

| Independent/Boutique | ASOS Marketplace, Etsy (Global) | Leverage a niche audience that values uniqueness, vintage, and small-batch production. |

| Resale/Circular Fashion | Poshmark (US), Vinted (EU), eBay (Global) | Low commission options exist, but often rely on C2C or overstock inventory models. |

Key Considerations for Global eCommerce Expansion

When scaling your fashion brand across marketplaces, consider the following:

- Returns Management: Fashion has the highest return rates (often 20-40%). Platforms like Zalando and Amazon FBA specialize in managing this volume, which is critical for profitability.

- Size & Fit: Inconsistent sizing is the top reason for returns. Leverage AR/VR try-on features (if available) or highly detailed size charts to mitigate this.

- Cross-Border Logistics: European expansion requires navigating different VAT and customs rules. Platforms like Zalando and Amazon EU provide infrastructure to simplify this complexity.

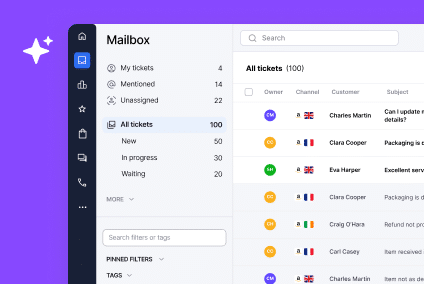

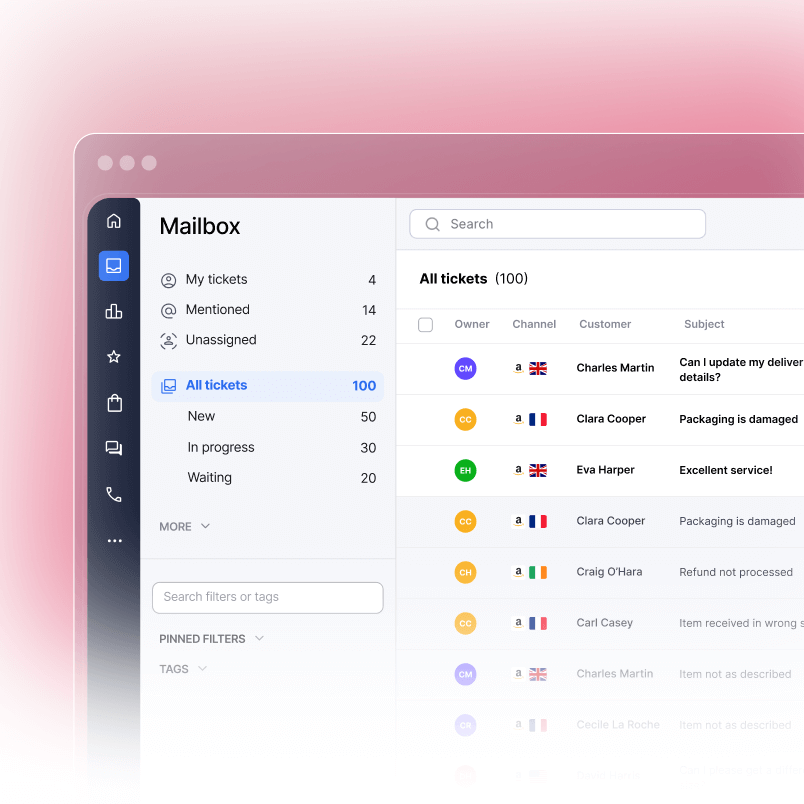

- Customer Service: Managing product inquiries (sizing, materials, tracking) and returns across 10+ global channels is impossible without technology. A centralized eCommerce helpdesk solution is necessary to manage the high volume of fashion-related customer tickets efficiently.

Takeaways for Fashion Brands Ready to Scale in 2025

Fashion marketplaces are more than just sales channels; they’re engines for growth. They allow brands to reach global audiences, benefit from built-in marketing power, and align with the way today’s consumers prefer to shop. Success comes down to choosing the right platforms and executing your strategy effectively.

To thrive, focus on:

- Selecting marketplaces that fit your brand and audience

- Maintaining consistent product data and imagery

- Using automation tools to scale efficiently

With the right approach, you can grow globally, stay agile, and deliver a seamless, trustworthy shopping experience, no matter where your customers are.

Need help setting up or want to see how eDesk can simplify your marketplace management? Book a demo with our team today, and we’ll walk you through everything you need to get started.