Nachdem Bitcoin, Ethereum und Dogecoin im letzten Jahr Schlagzeilen gemacht haben, ist es schwer, die Auswirkungen von Blockchain-basierten Kryptowährungen auf den Alltag nicht zu bemerken. Wie wirken sich Kryptowährungen und Blockchain im E-Commerce also speziell auf Online-Händler aus?

Als alternatives Zahlungssystem, das auf dem Blockchain-Ledger aufbaut, hat die Kryptowährung als Alternative zu traditionellen Investitionen, traditionellen Währungen und traditionellen Bankgeschäften an kultureller Bedeutung gewonnen. Der gewählte Bürgermeister von New York City, Eric Adams, sorgte vor kurzem für weltweite Schlagzeilen, als er nach seinem Sieg im Rennen um das Bürgermeisteramt sagte, dass er wünschte sich, in Bitcoin bezahlt zu werden und hoffte, dazu beizutragen, New York zu einer kryptofreundliche Stadt.

Da der Wettlauf um die Etablierung von Kryptowährungen als Mainstream-Alternative zum traditionellen Bankwesen immer intensiver wird, ist es wichtig zu verstehen, was Kryptowährungen sind, wie sie Hand in Hand mit dem Blockchain-Ledger funktionieren und wie sich diese beiden Technologien auf die eCommerce-Branche auswirken werden.

So wie in den 1990er Jahren Online-Kreditkarten-Zahlungsgateways den eCommerce erst möglich machten und dann PayPal, Venmo und andere Drittanbieter alternative Zahlungsoptionen anboten, muss die eCommerce-Branche jetzt mit dem Aufkommen von Kryptowährungen rechnen und damit, was es für eCommerce-Unternehmen bedeutet, diese Zahlungsmethode zu integrieren.

Mit der Kryptowährung kommt die Blockchain – das transparente, digitale Hauptbuch, in dem alle Kryptowährungstransaktionen aufgezeichnet werden. Blockchain bietet E-Commerce-Marken viele Vorteile, darunter schnellere und kostengünstigere Geschäftsprozesse sowie eine höhere Datensicherheit.

Während der Hype um Kryptowährungen zunimmt, akzeptieren Marken, Marktplätze und Zahlungsabwickler zunehmend Kryptowährungen als Zahlungsmittel für Waren und Dienstleistungen. Mit dieser Entwicklung wird es immer schwieriger, die Auswirkungen von Kryptowährungen und der Blockchain auf den E-Commerce zu ignorieren. Wenn Sie die potenziellen Auswirkungen dieser Technologie verstehen, können Sie eCommerce-Marken helfen, wertvolle Chancen für zukünftige Geschäfte zu erschließen.

Beginnen wir damit, einen Einblick und ein Verständnis dafür zu gewinnen, was Kryptowährung und die Blockchain sind und welche Auswirkungen sie auf die eCommerce-Branche haben können.

Kryptowährungen und Blockchain verstehen

Eine Kryptowährung (oft abgekürzt mit „Krypto“) ist eine digitale Währung, die zum Kauf von Waren und Dienstleistungen verwendet wird. Sie wird als Vermögenswert mit variablem Wert betrachtet, im Gegensatz zu Fiat-Währung (oder Bargeld, wie wir es kennen), die einen festen Wert hat. Kryptowährungen werden dezentral kontrolliert, was bedeutet, dass sie im Gegensatz zu traditionellen Währungen nicht von Banken oder Regierungen reguliert werden.

Stattdessen werden Transaktionen, die mit Kryptowährungen und Blockchain im eCommerce getätigt werden, von einem dezentralen Netzwerk ohne zentralen Server verifiziert, das die Verschlüsselung nutzt, um jede Transaktion zu verfolgen und die Freigabe jeder Währung zu kontrollieren. Zur Sicherung von Online-Transaktionen wird ein Online-Ledger mit starker Kryptographie verwendet. Dieses Hauptbuch wird als Distributed Ledger Technology (DLT) bezeichnet, die gemeinsame Datenbank, in der jede Transaktion einer bestimmten Kryptowährung aufgezeichnet wird.

Von allen DLTs ist die Blockchain die am weitesten verbreitete. Blockchain ist weder eine Programmiersprache noch eine Anwendung, sondern eine neue Technologie. Es handelt sich um ein sicheres Online-Ledger, das jede an einem bestimmten Ort getätigte Transaktion aufzeichnet. Sie ermöglicht es Nutzern, digitale Vermögenswerte wie Kryptowährungen zu teilen und sicher zu speichern. Mithilfe der Blockchain werden Kryptowährungstransaktionen aufgezeichnet, und die Informationen können nicht bearbeitet oder gelöscht werden, so dass eine dauerhafte Aufzeichnung der mit verschiedenen Kryptowährungen durchgeführten Transaktionen entsteht. Das ist, kurz gesagt, die Funktionsweise von Kryptowährungszahlungen.

Die Beliebtheit von Kryptowährungen bei Verbrauchern

Während Bitcoin (abgekürzt BTC) die erste Kryptowährung war, gibt es heute weltweit über 4.000 Kryptowährungen. Da Bitcoin der erste war, ist er zu einem Gattungsnamen für Kryptowährungen geworden. Viele Menschen verwenden den Begriff „Bitcoin“, wenn sie sich auf eine Kryptowährung beziehen, so wie man einen Staubsauger als „Staubsauger“ bezeichnen würde!

Ein großer Teil der Popularität von Bitcoin liegt darin begründet, dass er endlich ist. Bitcoin wurde von Satoshi Nakamoto mit Blick auf ein begrenztes Angebot geschaffen; nur 21 Millionen Bitcoins sind im Umlauf. In gewisser Weise ähnelt Bitcoin damit dem Gold, da es nicht endlich ist. Viele glauben, dass Nakamoto Bitcoin absichtlich auf diese Weise entwickelt hat, um eine elektronische Währung zu schaffen, die inflationssicher ist.

Bitcoin ist jedoch nicht die einzige Art von endlicher Kryptowährung. Andere Kryptowährungen mit einem endlichen Angebot sind Litecoin (84 Millionen), Ripple (100 Milliarden), Dash (18,9 Millionen) und IOTA (2,8 Milliarden). Neben Bitcoin und diesen Währungen gibt es weitere beliebte Kryptowährungen wie Ethereum, Dogecoin und Shiba Inu, die alle von Tesla- und SpaceX-CEO Elon Musk gelobt und in die er investiert hat.

Kryptowährungen werden von Verbrauchern auf der ganzen Welt genutzt, wobei die Akzeptanz in den verschiedenen Ländern unterschiedlich hoch ist. Während zum Beispiel nur 6 % der Amerikaner angaben, Kryptowährungen zu besitzen oder zu nutzen, sind es in den USA satte 32% der Nigerianer haben. The reasons for this align with markets that have a higher rate of mobile commerce and less access to traditional banking methods. It stands to reason that for eCommerce sellers, accepting crypto as yet another form of payment can help unlock revenue streams in new markets.

Zahlungen in Kryptowährungen

Es wird geschätzt, dass weltweit, fast 4% der weltweiten Verbraucher halten Kryptowährungen, und rund 18.000 Unternehmen weltweit akzeptieren Kryptowährungen als Zahlungsmittel. Da das Vertrauen in Kryptowährungen wächst, beginnen immer mehr Einzelhändler damit, Kryptowährungen als Zahlungsmittel zu akzeptieren.

Zu den ersten Unternehmen, die Kryptowährungen akzeptierten, gehörte Microsoft, das 2014 damit begann, Bitcoin für die Nutzung in seinem Xbox-Onlineshop zu akzeptieren. Die beliebte US-amerikanische E-Commerce-Website Overstock.com akzeptiert Kryptowährungen als Zahlungsmittel, ebenso wie der US-amerikanische Mobilfunkanbieter AT&T.

In Großbritannien gibt es Einzelhändler, die Kryptowährungen akzeptieren, darunter Shopify, Whole Foods, Etsy und sogar der Kosmetikhändler Lush, der sich als eines der ersten globalen Unternehmen auf diese neue Form der Bezahlung eingestellt hat. Amazon akzeptiert noch keine Kryptowährungen als Zahlungsmittel, aber es hat kürzlich die Einführung einer eigenen exklusiven Kryptowährung diskutiert.

Wie eCommerce-Marken Kryptowährungen als Zahlungsmittel akzeptieren können

Obwohl Kryptowährungen wie Science-Fiction erscheinen mögen, sind sie sehr real und können von eCommerce-Unternehmen relativ einfach als Zahlungsoption akzeptiert werden. Es ist nicht weit hergeholt, dass Online-Unternehmen Kryptowährungen als weitere Zahlungsoption neben den typischen Mastercard-, Visa-, Debit- und PayPal-Optionen anbieten, die derzeit auf den meisten E-Commerce-Websites verfügbar sind.

Der einfachste Weg für eine eCommerce-Marke, Krypto-Zahlungen zu akzeptieren, ist die Verwendung eines Zahlungsabwicklers, der Krypto als Option anbietet. Der Preis für jedes Produkt wird in Fiat-Währung angezeigt (z.B. Pfund Sterling, Dollar usw.) und in den entsprechenden Kryptowert umgerechnet, wenn der Benutzer Krypto als Zahlungsmethode auswählt. Die Transaktion wird dann wie jede andere Zahlung sicher über ein Zahlungs-Gateway abgewickelt, mit dem einzigen Unterschied, dass die Transaktion für immer in der Blockchain gespeichert wird.

Das bedeutet, dass es eine historische Aufzeichnung dieser Zahlungstransaktion gibt, die nie verschwindet und im Hauptbuch gespeichert bleibt. Dies kann natürlich für Händler und Käufer nützlich sein, die langfristige Aufzeichnungen führen möchten, ohne Quittungen aufbewahren zu müssen. Mehr dazu in Kürze.

Praktischer ausgedrückt: Wenn Sie Kryptowährung und Blockchain im E-Commerce einsetzen, müssen Online-Händler ein Zahlungs-Gateway verwenden, das Kryptowährungen unterstützt. Beliebte Krypto-Gateways sind Bitpay, Blockonomics, Coinbase Handel, Coingate, Crypto.com Pay, und NOWPayments. eCommerce brands will need to ensure that the gateway they choose is compatible with the content management system they are using to run their online shop (e.g., WooCommerce, Magento, Shopify, etc.)

Vorteile der Akzeptanz von Kryptowährungen im eCommerce

Die Annahme von Kryptowährungen als Zahlungsmittel für eCommerce-Transaktionen hat mehrere Vorteile. Die vier wichtigsten Vorteile sind:

- Zahlungen in Kryptowährungen sind rückbuchungssicher.

Ja, das ist richtig! Transaktionen, die mit Kryptowährungen durchgeführt werden, unterliegen keinen Rückbuchungen. Das ist für E-Commerce-Verkäufer hilfreich, denn Rückbuchungen schmälern die Einnahmen, können das Konto eines Händlers gefährden und erfordern Zeit und Mühe, um sie zu lösen. Da Kryptowährungen wie virtuelles Bargeld funktionieren sollen, bei dem die Zahlungen dauerhaft sind, werden Kryptowährungstransfers im eCommerce so lange auf einem Treuhandkonto hinterlegt, bis beide Parteien die Transaktion bestätigen. Sobald die Transaktion abgeschlossen und in der Blockchain aufgezeichnet ist, kann sie nicht mehr rückgängig gemacht werden. - Die mit Krypto-Zahlungen verbundenen Transaktionsgebühren sind niedrig. Da Kryptowährungen nicht durch traditionelle Finanzinstitute oder Regierungen reguliert werden, finden sie direkt zwischen Käufer und Verkäufer statt. Dadurch entfällt der Mittelsmann, der die Gelder verwahrt, und die Bearbeitungsgebühren für Krypto-Zahlungstransaktionen sind niedriger (wenn überhaupt). E-Commerce-Marken können oft Krypto-Prozessoren finden, die extrem niedrige Gebühren anbieten, in der Größenordnung von nur 1 % für eine E-Commerce-Website mit hohem Volumen.

- Die Annahme von Krypto-Zahlungen eröffnet neue Märkte. Da es sich bei Kryptowährungen um eine einfache, bargeldähnliche Transaktion zwischen Käufer und Verkäufer handelt, die keiner Bank- oder Regierungsregulierung unterliegt, ist sie besonders attraktiv für den Handel in unterentwickelten Märkten wie Asien und dem Nahen Osten, wo viele Verbraucher „unbanked“ sind – d.h. nicht in einem traditionellen, westlich geprägten Bankensystem registriert sind. eCommerce-Marken, die Kryptowährungen akzeptieren, können ihr Umsatzvolumen in diesen Märkten steigern, während Wettbewerber, die keine Kryptowährungen akzeptieren, die Chance verpassen, mit Verbrauchern aus diesen Regionen Geschäfte zu machen.

- Transaktionen werden sicher in der Blockchain aufgezeichnet. Wie oben beschrieben, ist die Blockchain ein sicheres Online-Ledger, in dem jede Transaktion aufgezeichnet wird. Die Blockchain-Technologie ermöglicht es Nutzern, Kryptowährungen zu teilen und sicher zu speichern. Sie zeichnet Zahlungsvorgänge auf, so dass bei jeder Zahlung ein Eintrag in der Blockchain veröffentlicht wird.

Die Blockchain verknüpft einzelne Datensätze zu einer Liste, die als Kette bezeichnet wird. Wenn ein Kunde eine Zahlung mit Krypto sendet, wird ein Eintrag in der Blockchain veröffentlicht. Andere Computer im Netzwerk überprüfen, ob die Krypto-Daten nicht bereits ausgegeben wurden (und schützen so die digitale Währung vor Korruption). Da das Netzwerk jede Transaktion aufzeichnet, können die in die Blockchain eingegebenen Daten nicht gelöscht, geändert oder verfälscht werden.

Kryptowährungen im eCommerce: Worauf Sie achten müssen

Es gibt zwar nicht allzu viele Nachteile bei der Annahme von Kryptowährungen im eCommerce, aber einige potenzielle Fallstricke sollten Sie beachten.

Volatilität. As cryptocurrency is still relatively new and not subject to governance by traditional banking and government systems and regulations, it is susceptible to increased volatility. For risk-averse industry players, it may not be the right solution. That said, it’s important to note that cryptocurrency can always be converted to one’s local fiat currency, meaning that you can ‘cash out’ at any point to avoid market fluctuations in crypto valuation.

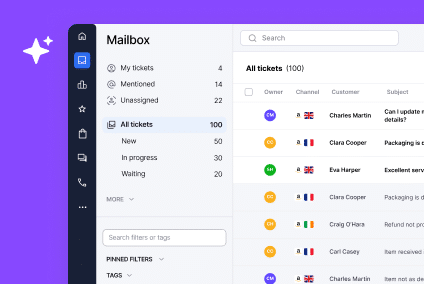

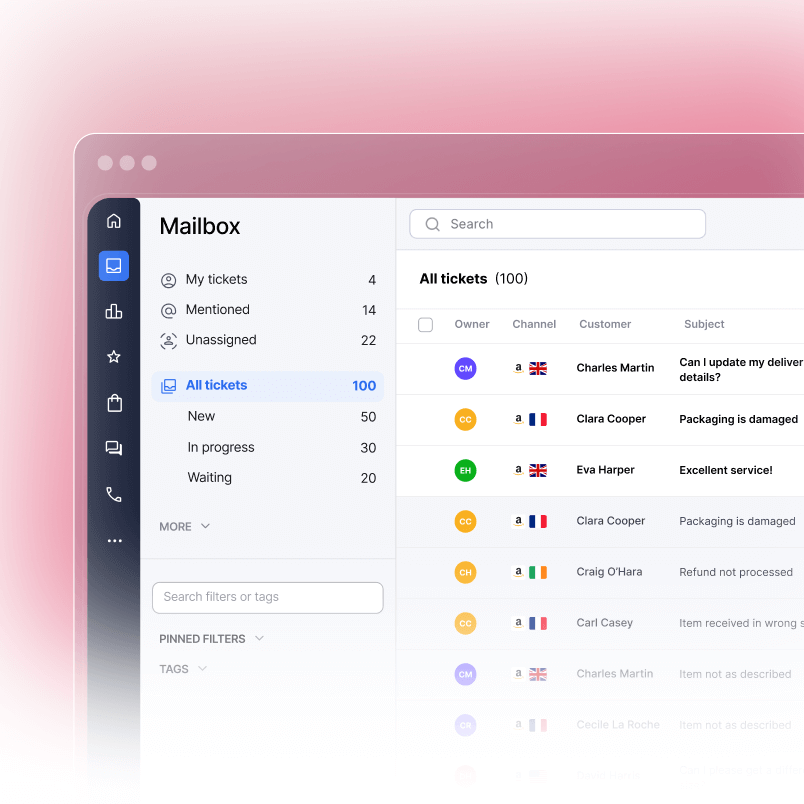

Auswirkungen auf den Kundenservice. Die Akzeptanz von Kryptowährungen und Blockchain im E-Commerce führt dazu, dass ein Online-Händler vermehrt Fragen zur Funktionsweise des Zahlungssystems stellen muss. Dies kann eine wichtige Überlegung für Marken sein, die ihr Kundenservicevolumen verwalten. Das Angebot einer einzigartigen Zahlungsoption wie Kryptowährungen kann die Arbeitsbelastung des Kundenservice-Teams erheblich erhöhen. Diese Herausforderung kann jedoch bewältigt werden, indem man den Support-Mitarbeitern das Wissen und die Tools an die Hand gibt, die sie für eine effiziente Arbeit benötigen.

Sicherheitsüberlegungen zur Blockchain im eCommerce

Auch wenn die Blockchain digitale Transaktionen sicher und dauerhaft aufzeichnet und die Richtigkeit mit anderen Computern in der Kette abgleicht, bedeutet dies nicht, dass eCommerce-Unternehmen, die Kryptowährungen akzeptieren, nicht auf Sicherheit achten sollten.

Verkäufer sollten sicherstellen, dass die neuesten Software-Updates installiert sind und dass die Kryptowährungs-Brieftasche des Unternehmens mit starken Passwörtern und einer Zwei-Faktor-Authentifizierung gesichert ist. Die Computer sollten regelmäßig gesichert werden, wobei jedes Backup durch Verschlüsselung vor Cyber-Bedrohungen geschützt werden sollte. Dies sind typische bewährte Sicherheitspraktiken, die jedoch besonders wichtig sind, wenn Sie mit digitalen Finanzwerten wie Kryptowährungen arbeiten.

Unternehmen können auch in Erwägung ziehen, eine Offline-Version ihrer Kryptowährungs-Brieftasche (bekannt als „Cold Storage“) für zusätzliche Sicherheit aufzubewahren. Häufige Überweisungen in die Landeswährung, die in einer traditionellen Bank aufbewahrt werden können, sind ebenfalls ein guter Schritt, um große Mengen an Einnahmen zu schützen.

Kryptowährung und Blockchain-Technologie als neue Grenze im eCommerce

Blockchain macht Transaktionen einfach, schnell und sicher und ist damit ideal für den elektronischen Handel. Durch sichere Online-Transaktionen kann Blockchain die Geschäftsprozesse verbessern und gleichzeitig eine bequeme Möglichkeit für Kunden bieten, zu bezahlen. Letztendlich kann es für Unternehmen sehr lukrativ sein, mit neuen Technologien Schritt zu halten und Kunden bessere Zahlungsmöglichkeiten zu bieten.

Vorausschauende Unternehmen setzen zunehmend Kryptowährungen als Zahlungsmittel ein. Die digitale Währung hat den E-Commerce, den Zahlungsverkehr und den Bankensektor auf den Kopf gestellt und sich gleichzeitig einen Namen als finanzielles Schwergewicht gemacht. Für E-Commerce-Marken, die einen zukunftsweisenden Ansatz bei den Zahlungsoptionen verfolgen, kann die Einführung von Kryptowährungen viele Vorteile mit sich bringen.

Demo buchen um mehr darüber zu erfahren, wie eDesk Ihrem eCommerce-Unternehmen helfen kann, ein hervorragendes Kundenerlebnis zu bieten. Sind Sie bereit, jetzt loszulegen? Versuchen Sie eDesk kostenlos für 14 Tage.